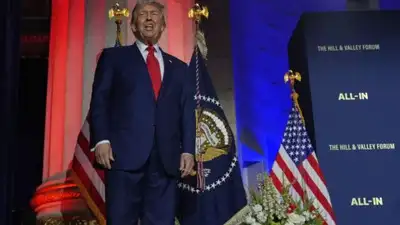

On July 23, 2025, President Donald Trump’s administration unveiled Winning the AI Race: America’s AI Action Plan, a sweeping policy agenda designed to dismantle regulation within the U.S. AI sector, accelerate infrastructure build‑out, and extend U.S. AI influence globally. Central to this plan are aggressive export initiatives enabling American AI hardware, models, and software to reach allies; a deregulatory push to fast‑track data centres and chip fabs; and procurement guidelines intended to favour “open” and “neutral” AI models aligned with American values.

Yet in response, China has steadily articulated a contrasting vision: one of inclusive governance, indigenous innovation, and global leadership beyond the U.S. tech model. This divergence reflects deepening competition over not only technology, but ideology, standards, and influence.

Table of Contents

China Pushes for Global AI Governance in Shanghai

Just days after Washington’s deregulatory turn, Chinese Premier Li Qiang used the stage at the World Artificial Intelligence Conference in Shanghai to call for the creation of a new international body dedicated to AI oversight. The proposal envisions a multilateral organisation—likely headquartered in Shanghai—focused on ensuring that AI development serves “equitable access”, especially among countries in the Global South, rather than being dominated by a few powerful states or corporations.

Li warned that AI risks becoming an “exclusive game,” reserved for a handful of tech giants. China’s proposal thus serves as a strategic rebuke to Trump’s narrative: where Washington foregrounds deregulation and competition, Beijing advances cooperation and rule‑making.

Building an Indigenous Ecosystem: Alliances from Chip to Model

China’s response extends beyond talk. Now, companies like Huawei, Biren, Alibaba, Tencent, SenseTime, and others have created two major alliances to integrate chips, AI architectures, and infrastructure for self‑reliance.

The “Model‑Chip Ecosystem Innovation Alliance” brings together chip designers and LLM developers; the Shanghai General Chamber AI Committee alliance integrates industrial AI across sectors. At the same conference, Huawei unveiled its CloudMatrix 384 system, which claims performance on par with Nvidia’s top hardware—while Alibaba showcased innovations like Quark AI Glasses, Tencent debuted a 3D world model, and Baidu revealed livestreaming technology powered by AI‐driven digital humans.

In effect, China is re‑creating its own vertically integrated AI ecosystem, reducing dependence on foreign suppliers.

Nvidia’s H20 Chip Saga: Tensions and Reversals

Meanwhile, U.S.–China technology relations have reached a dramatic inflexion point. Until recently, sales of Nvidia’s advanced H20 AI inference chips to the country were banned under previous U.S. export controls. President Trump’s administration announced a freeze on that ban in a bid to advance trade talks, signalling openness to exporting H20 chips if licensing is approved.

Nvidia CEO Jensen Huang, who has frequently criticised U.S. chip restrictions as counterproductive, welcomed the policy reversal. He noted that the export controls had inadvertently accelerated development of Chinese alternatives—and that China now boasts a “fantastic” AI sector with rising local chipmakers and model providers like DeepSeek, Alibaba, Tencent, and others. Huang stressed that true U.S. AI leadership depends not on isolation, but on the global standard‑setting power of its technology stack—aiming to replicate the ubiquity of the U.S. dollar.

On the Chinese side, Commerce Minister Wang Wentao reiterated China’s desire to remain open to foreign investment and praised these collaborations, even as local innovation accelerates

China’s Strategic Messaging: Innovation as Soft Power

China’s broader narrative is building momentum. In early 2025, the MSCI China Index surged over 25% as investors bet on a rebound fueled by cultural and technological dynamism, scholars noted as a growing “cool factor” in innovation, mainstream appeal, and economic resilience.

China is also stacking its influence through open‑source AI models, like DeepSeek’s R‑1, which is freely released to developer communities around the world and symbolises China’s push to shape AI norms globally.

At the same time, Beijing has reaffirmed its industrial strategies—such as Made in China 2025—which aim to secure autonomy and dominance in core technologies like AI and semiconductors by 2025 and beyond.

How China’s Reaction Illuminates the Geopolitical Stakes

Together, China’s responses to Trump’s AI strategies offer key signals:

- Governance vs. Growth: While the U.S. emphasises deregulation to boost innovation, China is positioning itself as the architect of global governance frameworks, mindful of ethical and security risks.

- Self‑Reliance vs. Dependency: Chinese firms are doubling down on indigenous infrastructure and models, forming alliances that blur lines between state planning and private incentives.

- Open vs. Closed Innovation: Beijing’s push for open AI models indicates a bid to attract global talent and influence, contrasting U.S. reluctance to embrace international regulation or data sharing.

- Influence via Inclusion: By emphasising shared governance and equitable access, China aims to curry favour with developing countries, casting its AI diplomacy as more inclusive than Washington’s transactional alliances.

- Market Access vs. Leadership: The H20 chip thaw suggests U.S. willingness to tolerate limited exports in order to maintain influence, but Huawei and others are proving that China can ultimately stand on its own.

What Comes Next in the AI-Tech Cold War?

The roadmap ahead is complex:

| Domain | U.S. Approach | China’s Approach |

|---|---|---|

| Regulation | Deregulation, streamlined infrastructure | Global governance body, safety and inclusivity focus |

| Exports | Relaxed controls, trade diplomacy | Domestic substitutes, chip‐model alliances |

| Talent & Standards | Promote American “tech stack” abroad | Foster open models, global south collaboration |

| Strategy | Assert American values, free‑speech AI bias rules | Challenge monopolies, regional leadership and soft power |

Despite recent U.S. concessions, China’s strategic autonomy is growing. Its domestic ecosystem alliances and open‑source offerings are steering global AI dynamics toward a multiplicity of influential players—and away from U.S. hegemony.

Executive Summary: A Turning Point in the AI Contest

China’s response to Trump’s AI Action Plan goes beyond diplomatic posturing. At a moment when Washington emphasises deregulating AI and extending American export influence, Beijing is laying the foundations for independent capabilities, values‑based governance, and international influence grounded in innovation and inclusion.

As U.S.–China technology policy diverges further, the global AI landscape looks less like a U.S. export machine and more like a multipolar field, with China actively shaping rules, infrastructure, and norms. Whether this leads to cooperation or confrontation may hinge on who drafts the rules for AI’s future.

Conclusion

China’s response—through its global governance proposal, ecosystem alliances, chip diplomacy, and open AI outreach—signals a confident, dual‐track strategy: remain engaged with global markets, while accelerating domestic leadership. The world is watching a shift from Chinese mimicry toward Chinese mastery.

In the months ahead, key questions include whether the U.S. will retain global influence through licensing and standard‑setting, and whether China’s open‑sourcing and inclusivity approach will attract allies and swap American influence. The tech landscape is no longer just about power—it’s about who writes the rules.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes