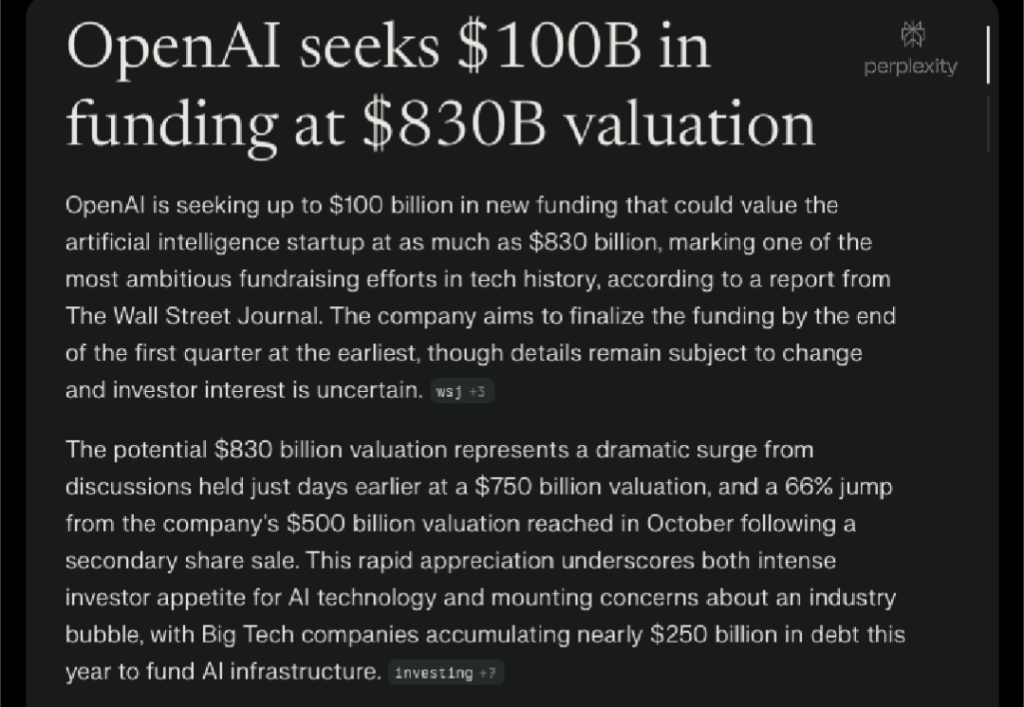

In a move that has captured global attention and stirred intense debate across Silicon Valley and beyond, OpenAI is reportedly in talks to raise a staggering $100 billion funding round that could place its valuation at around $830 billion. If successful, this would be one of the most ambitious fundraising efforts in the history of the technology sector and would underscore the central role artificial intelligence now plays in driving global innovation and investor appetite.

According to multiple reliable sources, including the Wall Street Journal, the AI powerhouse that developed ChatGPT is in discussions with potential investors about raising up to $100 billion by the end of the first quarter of next year. The target valuation of $830 billion highlights how far the company’s perceived worth has soared in recent months, although the terms of the deal are not yet final and could change as negotiations continue.

For many market watchers and tech industry insiders, this development represents both a bullish signal for AI’s economic potential and a reminder of the massive infrastructure and research costs that underpin cutting-edge AI development.

Table of Contents

What the Funding Round Could Mean for the AI Landscape

OpenAI’s reported plan to raise $100 billion is not just about setting a record. It reflects the intense financial demands associated with building and scaling advanced artificial intelligence systems. Training large language models, maintaining massive global data centres, securing high-performance chips and retaining world-class talent all come with very high price tags. Some industry analysts believe that only an injection of capital on this scale can sustain the company’s ambitious roadmap.

It is worth noting that earlier reports had hinted at discussions around a slightly lower valuation of about $750 billion, signalling that the figures are still in flux as OpenAI and its potential investors continue conversations.

But beyond the raw numbers lies a bigger narrative about how technology firms are financed in this new era of exponential digital transformation. AI startups are no longer small experimental labs. They are capital-intensive infrastructure builders with global reach, and investors are increasingly willing to commit enormous sums where they see potential for long-term dominance. At an $830 billion valuation, OpenAI would rival the most valuable companies on the planet, public or private.

Strategic Implications for Investors and Competitors

For investors, the possibility of a $100 billion round at such a lofty valuation presents both huge opportunity and significant risk. A raise of this size would likely attract a diverse group of backers, including sovereign wealth funds, institutional investors and major technology conglomerates. Already, SoftBank and other big players have shown interest in backing AI initiatives globally.

One reason behind this robust interest is the sheer economic potential of AI tools like ChatGPT, which have seen explosive adoption across industries ranging from healthcare to finance to education. Many companies are integrating AI into core services, driving demand for more powerful models and greater computing infrastructure.

However, investor caution surfaces in some corners too. The broader AI financing boom has cooled this year, with some market participants questioning whether heavy debt-fuelled spending is sustainable in the long run. High valuations bring pressure to deliver real earnings growth, and OpenAI’s operational costs are enormous, with its compute needs exceeding traditional cloud credits and partnerships.

For competitors like Google, Anthropic and others, OpenAI’s fundraising push sets a new benchmark. These companies are also vying for leadership in generative AI, and massive capital raises elsewhere may influence how they prioritise their own strategies.

What This Means for the Future of OpenAI

At its core, this funding effort is about securing the future of a company that has become synonymous with modern artificial intelligence. From its early days as a research lab to its current status as one of the most talked-about tech firms globally, OpenAI’s journey has been meteoric. Its revenue and user adoption have grown rapidly, but so has its need for funds to stay ahead of competitors and keep pushing boundaries.

If OpenAI succeeds in this fundraising round, it could dramatically strengthen its balance sheet and provide runway for long-term projects, including even more advanced AI systems that may reshape how humans interact with machines. There have also been ongoing discussions about a potential initial public offering (IPO), possibly as early as the second half of 2026, which could further transform how the company is owned and valued.

While the company has not officially commented on the fundraising reports, its actions suggest a clear drive to expand its global footprint, invest heavily in research and infrastructure, and solidify leadership in the fast-evolving AI ecosystem.

Broader Global and Economic Considerations

OpenAI’s funding strategy also reflects larger trends in technology and capital markets. Worldwide investment in AI has ballooned in recent years, with companies across sectors pouring resources into machine intelligence research and deployment. The scale of this reported $100 billion round symbolises how transformative AI is perceived to be for the future of work, commerce and innovation.

At the same time, such massive valuations and capital injections raise questions about market sustainability and competition. Critics caution that overly aggressive valuations can create bubbles, especially in fast-moving sectors where future profits are uncertain or highly speculative. Others argue that the investments are necessary to stay competitive against global rivals, particularly as countries and companies race to develop the most capable AI technologies.

From Lagos to London to Silicon Valley, investors and policymakers alike are grappling with the implications of this next phase of tech financing. What happens with OpenAI could set precedents for how AI firms are funded and regulated in the coming decade.

Conclusion

OpenAI’s reported attempt to secure a $100 billion funding round at an $830 billion valuation is a defining moment in the history of artificial intelligence investment. It signals both the stunning growth of the company itself and the broader economic forces reshaping how technology is built, financed and governed on the world stage.

Whether this fundraising effort succeeds or evolves into something different, the conversation it has sparked about the future of AI, capital allocation and technological leadership is already substantial. For Nigeria and markets across Africa, developments like this offer a window into how global innovation dynamics are shifting and what opportunities and risks lie ahead.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes