Concerns about changing fraud threats in the banking and payments industry have been voiced by the Central Bank of Nigeria (CBN), which has warned that thieves are using increasingly advanced techniques.

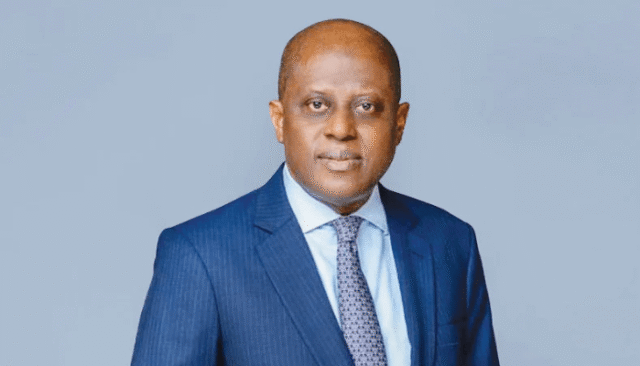

Speaking at the 2026 Nigeria Electronic Fraud Forum (NeFF) technical kick-off session in Lagos on Wednesday, January 21, 2026, Philip Ikeazor, CBN deputy governor for financial system stability, stated that since the NeFF platform’s inception in 2011, ongoing cooperation has greatly increased the security and robustness of Nigeria’s payments system.

CBN urges faster response to fraud trends

Ibrahim Hassan, director of the development financial institutions supervision department, spoke on behalf of Ikeazor, who pointed out that despite the rapid growth of digital transactions, industry-wide collaboration has helped reduce losses associated with fraud.

He cited significant accomplishments such the widespread use of EMV chip-and-PIN cards, the introduction of two-factor authentication, enhanced transaction monitoring, centralised fraud reporting, and the connection between the national identification number (NIN) and bank verification numbers (BVN).

According to him, new risks demand quicker, more coordinated and forward-looking solutions. He said: “Emerging threats such as social engineering, SIM-swap abuse, insider compromise and Authorised Push Payment (APP) scams require faster, integrated and proactive responses.”

He continued by saying that while implementing enterprise-wide fraud management systems driven by shared information and real-time data analytics, the industry is aiming for fraud reaction times of less than 30 minutes.

Customers were previously cautioned by Nigerian banks to be on the lookout for fraudulent operations that target personal banking information.

Speaking at the occasion as well, Rakiya Yusuf, chairman of NeFF and director of payments system supervision at CBN, emphasised the necessity of ongoing collaboration between law enforcement, financial institutions, payment service providers, and regulators.

She said while progress has been made in identity management and transaction security, emerging threats require standardised frameworks, faster intervention and proactive use of ISO 20022 messaging standards and analytics to maintain fraud reduction gains.

Join Our Social Media Channels: