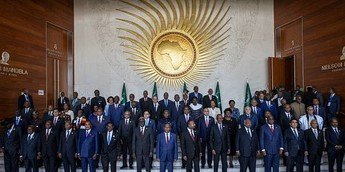

At the recent summit in Luanda convened by the African Union (AU), a bold new infrastructure vision emerged, as the continent’s leaders carved out an investment blueprint worth US $170 billion annually to drive integration, mobility and growth across Africa, according to Modern Diplomacy.

In a context where global forces such as massive “global tech layoffs” ripple through economies worldwide, Africa’s infrastructure push offers a different narrative: one of mobilisation, self-determination and future-proofing.

Chairing the summit, President João Manuel Gonçalves Lourenço of Angola reminded delegates that “we must move from words to action … this summit represents a decisive step” in realising the ambitious figures. His message resonated in Lagos, Abuja and beyond, signalling that infrastructure is no longer a backdrop but a strategic lever for the 55-nation bloc.

Table of Contents

Why the US $170 billion figure matters

The headline target – between US$130 billion and US$170 billion a year needed for Africa’s infrastructure – has been repeated by the AU in recent years. According to the AU, closing the aviation gap alone will cost between US$25-30 billion over the next decade.

From a Nigerian perspective, when you consider poorer transport, unreliable power supply and limited digital connectivity, the investment gap is felt in everyday life. One Lagos-based entrepreneur told me how freight delays and power disruption still cost her more than the “global tech layoffs” elsewhere — a signal of how infrastructure underpins competitiveness.

Among the key statistics:

- Passenger air traffic in Africa is projected to triple from 160 million in 2024 to nearly 500 million by 2050.

- The AU’s blueprint envisages not just airports and aerodromes, but modern navigation, meteorological systems and green energy integration at aviation hubs.

- Only about half the infrastructure investment Africa needs today is being committed annually, according to back.africaeuropefoundation.org.

What this tells us is that the AU’s plan is not just ambitious — it is urgent. The continent cannot wait while a wave of “global tech layoffs” benchmarks are ringing elsewhere; Africa must step into its connected future.

How the investment plan is structured

At the Luanda summit, the narrative shifted from talk to specific mechanisms. The AU signed several key memoranda:

- An MOU between the African Social Security Association and AUDA‑NEPAD to channel African pension funds into infrastructure.

- A partnership with Qatar Airways, establishing US$500 million for renewable-energy and climate-aligned industrialisation.

- The Angola Export & Trade Facility is to promote regional cooperation and trade flows.

On the technical side, the plan emphasises cutting-edge systems: A-CDM (Airport Collaborative Decision Making), SWIM (System-Wide Information Management), and renewable-energy installations at airports.

For Nigeria and other African economies, this means that capital is shifting from conventional sectors (oil, raw materials) into connectivity, climate resilience and digital infrastructure-enabled systems. And while the world reports “global tech layoffs”, those job losses remind us of the fragility of reliance on a single sector — Africa’s push into infrastructure reflects diversification.

What this means for Nigeria & West Africa

For Nigeria, the AU’s infrastructure push offers both opportunity and challenge. On one hand, stronger air, road, rail and digital links mean deeper integration with the rest of the continent. On the other hand, the mobilisation of hundreds of billions in investment will require governance, transparency and capacity building.

In practical terms:

- An improved aviation network under the Single African Air Transport Market (SAATM) means cheaper, faster air travel and cargo movement. Nigeria’s domestic carriers and hub status could benefit.

- Digital backbone and data systems push mean Nigeria’s fintech and tech hubs could leverage links into regional corridors rather than simply battling “global tech layoffs”.

- Pension-fund channelling and domestic investment (rather than only foreign financing) means Nigeria’s institutions may increasingly tap infrastructure bonds rather than outside borrowings.

Yet, Nigerian policymakers must ensure:

- Projects are bankable and transparent — the AU emphasises this.

- Local capacity is built so that infrastructure is maintained. According to the AU, maintenance of existing infrastructure is already two-thirds of the investment needed.

- Regional cooperation must improve so that Nigeria and its neighbours benefit from cross-border projects and not only national ones.

In a world where corporate boards review “global tech layoffs” and adjust business strategies accordingly, Nigerian infrastructure planners should also adjust: anticipate disruption, digital transformation, and embed resilience into the physical build.

The broader strategic significance

Beyond the numbers and frameworks, the AU’s infrastructure investment plan signals a deeper shift: Africa is asserting agency over its development, moving away from the “aid and donor” logic toward an “allied partnerships” model.

This matters for Nigeria and Africa at large in several ways:

- Sovereign control over infrastructure means more strategic alignment with the continent’s trade agenda, notably the African Continental Free Trade Area (AfCFTA).

- Enhanced connectivity — physical and digital — bolsters Africa’s ability to tap global supply chains rather than merely being raw-material exporters. In a period where “global tech layoffs” indicate shifting global value chains, Africa’s infrastructure could be the enabler of next-gen value creation.

- Climate-smart infrastructure embeds sustainability in the core of development: Nigeria, which faces both floods and climate-related disruption, stands to benefit from systems built for today’s world and tomorrow’s.

Finally, for the young, fast-growing Nigerian population, infrastructure is the platform for jobs, movement and opportunity. As corporate announcements about “global tech layoffs” dominate headlines abroad, Africa emphasises tangible building: airports, corridors, navigation systems, and pension funds repurposed for growth.

Conclusion

The AU has set the continent on a path to mobilise US$170 billion annually for infrastructure — a plan rooted in strategy, realism and continental self-drive. Nigeria, like its peers, carries much to gain — if it can translate vision into implementation, build capacity, uphold governance, and leverage connectivity for prosperity. Amid a global era of “global tech layoffs”, Africa’s infrastructure agenda offers a parallel story: of building, of integration and of stepping into a connected future.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes