Africa’s startup scene is drawing growing attention from big corporate investors in 2025 as corporate venture capital investment hits its strongest levels in three years. Fresh data shows that the number of corporate-backed rounds surged in the first half of this year, suggesting a pivotal shift in how global and local firms view opportunities on the continent. Analysts and investors alike say this momentum reflects deeper confidence in African innovation, even as structural gaps remain.

Table of Contents

Investment Activity Soars with New Players Entering the Market

In the first six months of 2025, Africa recorded a 44 percent increase in corporate venture capital funding rounds compared with previous years. That translated into 26 deals, the highest recorded in any half-year period since the data began tracking this segment. Investors from across the world, including Asia, the Middle East and traditional Western markets, are now deploying capital into African startups at levels not seen since before the global tech slowdown.

Local stakeholders say this uptick reflects more than just numbers. Historically, many foreign investors avoided Africa because of perceived risks such as political uncertainty, currency volatility and infrastructure gaps. But today, prominent corporate venture capital arms from India, Japan, the UAE, Qatar and Saudi Arabia are showing real interest. Chinese investors, although often less visible on public data, are likewise active, particularly in countries like Nigeria.

Nigerian companies themselves are stepping up. Flour Mills of Nigeria participated in a $20 million Series A round for OmniRetail, a B2B e-commerce platform that serves retailers across West Africa. Elsewhere, Moroccan banks and agribusiness firms have launched corporate venture units to back startups in their home region, adding more diversity to Africa’s investment landscape.

Startups Scale Beyond Borders and Build Global Brands

One striking trend is how African startups are no longer only local players. Successful tech firms are expanding internationally, tapping markets in Europe, North America and Asia. For example, LemFi started out solving remittance challenges for Nigerians, but now operates in the UK and US markets and partners with global payment networks to serve diaspora customers from many countries.

Another notable story is Moove, a mobility fintech that began in Nigeria with ridesharing services linked to Uber. Over time, it grew to operate in multiple African countries and then into dozens of cities across five continents, managing a global fleet of nearly 40,000 vehicles and serving major transport platforms worldwide. It now counts institutional backers such as BlackRock, Uber and global banks.

Egypt’s Trella, described by some as an “Uber for logistics,” has also leveraged regional expansion into the UAE and Saudi Arabia. These examples show how innovation seeded in Africa can scale outward, creating regional champions with global reach.

Uneven Spread of Funding Across Countries and Sectors

Even with overall progress, corporate VC investment remains highly concentrated in a few countries. Egypt, South Africa, Kenya and Nigeria account for the bulk of deals, with most other nations recording very few or none at all. Still, some countries including Tunisia, Ghana, Ethiopia, Togo and Uganda saw corporate investment for the first time in this measurement period.

The dominant sector in corporate funding was fintech, capturing half of all tracked deals. Africa’s youthful populations and rapidly growing digital economies have helped financial technology firms attract substantial capital. Nigerian fintechs such as Moniepoint and Opay raised significant rounds, underscoring the vibrancy of that nation’s ecosystem.

Elsewhere, South African startups in digital insurance raised large investments, and the island of Seychelles saw unusual clarity as a hub for crypto and blockchain ventures, with multiple deals involving global digital asset firms.

Agritech and IT businesses are also beginning to get more attention. From a digital marketplace linking farmers to buyers in South Africa, to Tunisian tech that generates drinking water from air, early signs show interest beyond just finance. Corporations in food, drink and agribusiness are now backing solutions that link agriculture to technology, drawing capital into areas that could address food security and rural productivity.

Challenges and What Comes Next

Despite this renewed momentum, Africa’s corporate VC scene still faces significant hurdles. Most deals are at early stages such as seed and Series A, with relatively few later-stage rounds that can help companies scale to global size. Only a tiny number of African firms secured Series C funding during the same period, reflecting the continent’s ongoing struggle to build unicorn-level scaleups.

Experts also point to structural issues that hamper sustained corporate venture capital growth. These include limited VC expertise inside corporate organisations, short lifecycles for investment programmes, and a lack of long-term strategic focus that aligns with Africa’s unique market conditions. Critics argue that for Africa to retain and scale its most promising startups, both local and foreign corporate investors must adopt practices that go beyond short-term gains and navigate administrative and regulatory challenges more effectively.

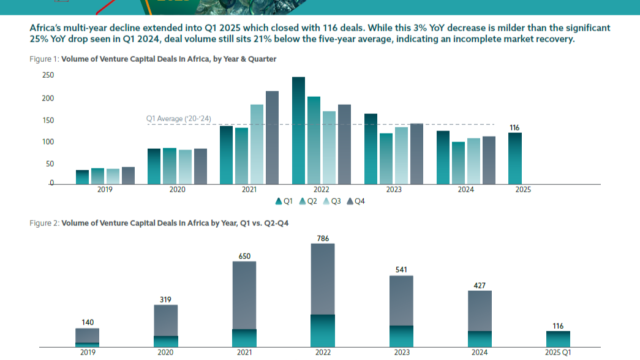

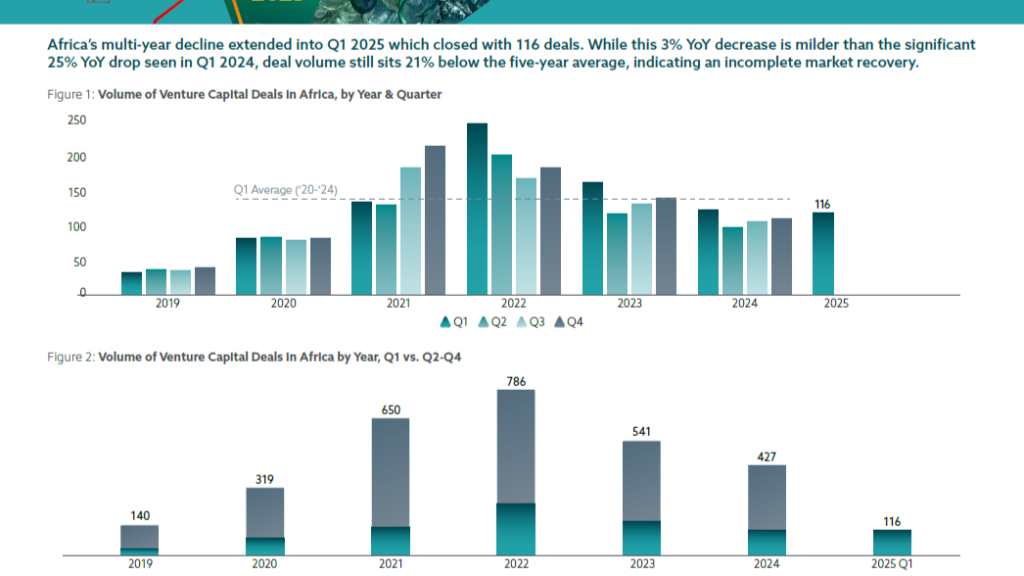

Broader market dynamics also matter. While corporate capital is rising, overall venture capital activity in Africa has been cautious this year, with more emphasis on early-stage deals and alternative financing options such as venture debt gaining traction. Investors are increasingly seeking balanced risk strategies that combine equity and debt to support startups during growth phases.

As Africa cements its position as a compelling destination for innovative investment, the horizon looks promising. With the right mix of strategic corporate backing, supportive policy frameworks and strengthened investor expertise, the continent’s startup ecosystem could move from early-stage promise to sustained global competitiveness. Corporations that partner wisely with founders and local ecosystems stand to unlock both economic and social value across Africa’s diverse markets.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes