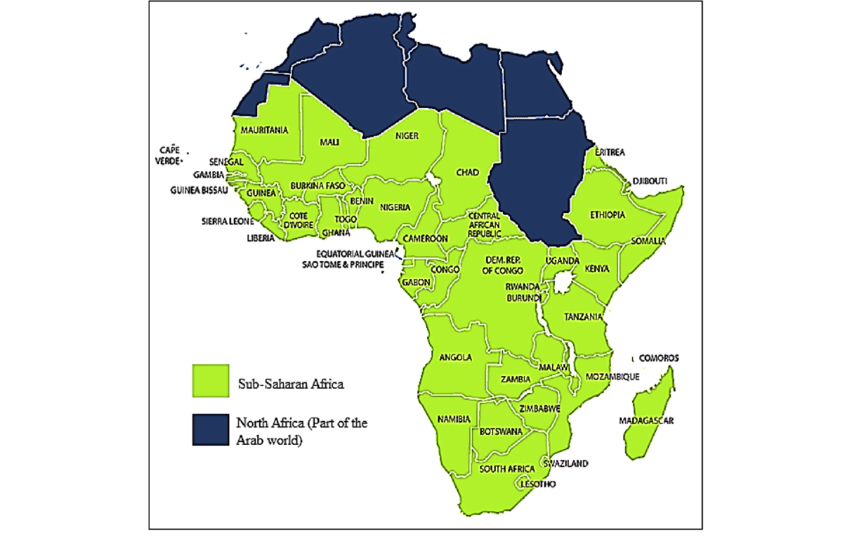

In a welcome turn of events, the World Bank has raised its forecast for economic expansion in Sub-Saharan Africa, citing easing inflation and more stable currencies as key factors. The fresh projection lifts growth to 3.8 per cent in 2025, up from 3.5 per cent earlier in the year, according to Reuters.

This upward revision signals cautious optimism among policymakers and development watchers across the continent. As inflation recedes and interest rate pressures ease, governments now find more fiscal room to steer policies that might create jobs, improve education, and support long-term development.

Yet, significant headwinds remain. High debt burdens, global trade uncertainties, and the pressing need to generate youth employment cast shadows over the brighter outlook. In particular, for countries such as Nigeria, Ethiopia, and Côte d’Ivoire, the new forecast raises both hope and challenges.

Table of Contents

What’s Driving the Upgrade in Sub-Saharan Africa — And What Risks Remain

The Upside: Lower Inflation, Stable Currencies, Private Demand

One of the strongest drivers behind the improved forecast is falling inflation across many Sub-Saharan economies. As consumer price pressures ease, households regain some purchasing power, which in turn fuels private consumption.

Coupled with that, many currencies that had depreciated sharply are now stabilising against the U.S. dollar. That stability gives central banks space to cut or soften interest rates—another boost to borrowing, business investment, and growth.

In its Africa Pulse report, the World Bank also expects growth across the region to accelerate further, to an average of 4.4 per cent annually over 2026–27.

The Caution: Debt, External Pressures, Informality

But the better figures do not mean the challenges have disappeared. For one, several countries are grappling with heavy fiscal burdens and debt service obligations that absorb a large share of government revenue.

International trade tensions and uncertainty over policies in major economies also pose a risk to demand for African exports.

A particularly tricky issue is youth unemployment. The growing ranks of young people entering the job market need decent work; too often, job growth is limited to low-pay, informal roles. In Kenya, Nigeria, Madagascar and elsewhere, protest movements have partly been responses to frustration over jobless youth.

Moreover, the progress is uneven. While some countries are benefiting from the rebound in commodity exports or improvements in services, fragile states, conflict zones, and drought-hit regions lag behind.

The World Bank cautions that the recovery remains gradual and incomplete, rather than a sharp rebound.

Implications for Jobs, Education and Public Funding

The shift in macroeconomic indicators is not just about percentages and forecasts — it has real implications for jobs, education funding, and the quality of life for millions.

Jobs: From Informal to Formal, Quality Over Quantity

A prime concern is ensuring that growth translates into decent jobs for youth. The World Bank emphasises that small and medium enterprises (SMEs) will be crucial in absorbing labour, especially if governments can create more business-friendly conditions.

But the quality of jobs matters just as much. “These jobs have to be jobs that provide a living wage and secure lives,” said Andrew Dabalen, Chief Economist for Africa at the World Bank.

In many countries across Sub-Saharan Africa, informal employment dominates. Underinvestment in skills, weak institutions, and inadequate infrastructure make it hard for firms to scale or formalise. Transitioning more workers into stable, formal employment is essential to reducing vulnerability and boosting productivity.

Education, Skills and Human Capital

For growth to be sustainable, the region must invest more in human capital — schooling, vocational training, and higher education. If inflation eases and interest burdens lighten, more public revenue could be allocated to education and skills development.

Yet, many governments are under pressure to balance debt repayments and social spending. In resource-constrained settings, education funding often competes with debt servicing.

If properly targeted, improved education can help young people access higher-value jobs, thereby reinforcing the virtuous cycle: growth leads to revenue, which funds education, which leads to more productive workers and further growth.

Public Services and Social Protection

Beyond education, easing inflation opens space for governments to maintain or expand social safety nets, health care, infrastructure, and pro-poor spending. This is especially important in times of shocks — from climate, pandemics, or food crises.

But continued fiscal discipline is essential. The upside to disinflation will be eroded if public debt and deficits spiral out of control.

What Must Africa’s Leaders and Stakeholders Do Now

The improved forecast is an opportunity — but only if carefully managed. Here are priorities that policymakers, donors, and civil society must keep front of their minds:

- Deepen structural reforms and ease business constraints

Cutting red tape, improving governance, strengthening property rights, and enabling credit flows will help firms grow and employ more people. - Focus on quality job creation, especially in the formal sector

Policies should encourage firms to shift from informal to formal status, adopt productivity-enhancing technologies, and invest in workforce training. - Safeguard and increase investment in education and health

Even with fiscal pressure, protecting human capital spending must remain a priority. Consider targeted subsidies, public–private partnerships, and efficiency reforms. - Strengthen debt management and fiscal buffers

Governments need to balance growth with fiscal prudence. Transparent debt management, efficient tax systems, and prudent borrowing are vital. - Bolster resilience to shocks

Climate adaptation, food security, early warning systems, and risk management must be built into planning to reduce vulnerability to droughts, floods, or global volatility. - Mobilise international support where required

Donors, MDBs (multilateral development banks), and development partners can help through concessional finance, technical assistance, and supporting policy reforms.

This upward revision by the World Bank is not a guarantee of prosperity, but rather a signal: the winds may be shifting — if Africa and its leaders steer well, more job opportunities, stronger education systems, and better lives could be within reach.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes

READ THE LATEST EDUCATION NEWS