FIRS Rejects Atiku’s Claims of Monopoly Over National Revenue Collection

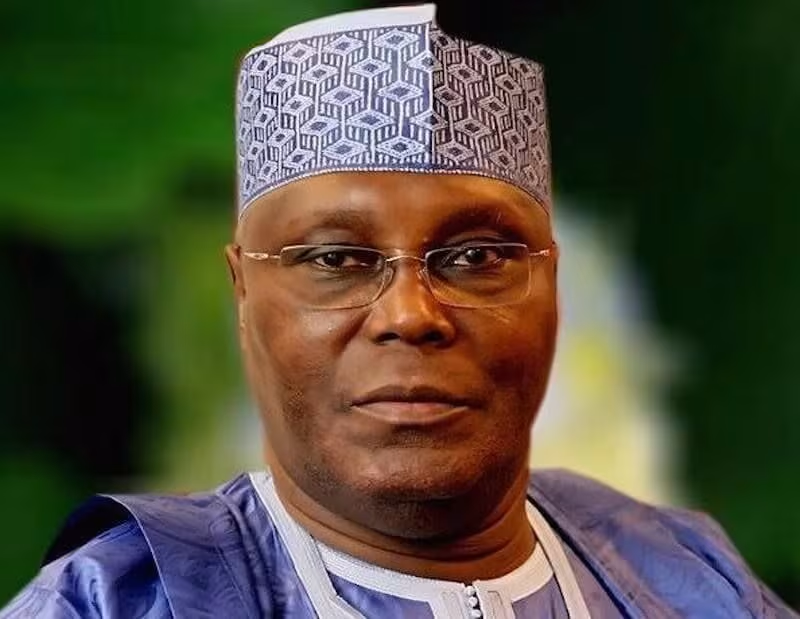

The Federal Inland Revenue Service (FIRS) has strongly refuted allegations made by former Vice President Atiku Abubakar, who claimed that a private firm, Xpress Payments Solutions Limited, has been granted a monopoly over Nigeria’s national revenue-collection system.

In a comprehensive statement, the FIRS dismissed the claims as “incorrect, misleading, and politically motivated,” asserting that its payment system is built on a multi-channel, competitive framework involving several key financial technology players.

Table of Contents

FIRS Rebuttal: No Monopoly Over Revenue Collection

The Multi-Channel Payment System

The Backstory: Atiku’s Allegation of ‘Lagos-Style Cartel’

FIRS Clarification: PSSPs Do Not Control Government Revenue

Commitment to Transparency and Tax Reforms

1. FIRS Rebuttal: No Monopoly Over Revenue Collection

The FIRS, through Aderonke Atoyebi, Technical Assistant on Broadcast Media, categorically denied operating any single-gateway system for tax payments.

“For clarity, the FIRS does not operate any exclusive or single-gateway revenue-collection arrangement, and no private entity has been granted a monopoly over government revenues,” the agency stated.

The FIRS emphasized that politicizing this administrative and technical process is unnecessary and detrimental to ongoing efforts to modernize Nigeria’s tax system.

2. The Multi-Channel Payment System

Contrary to the claims of exclusivity, the FIRS confirmed that it operates a robust, multi-vendor framework that ensures ease and efficiency for taxpayers nationwide.

The agency employs a multi-payment Solution Service Provider (PSSP) structure that includes several leading financial technology platforms:

Quickteller

Remita

Etranzact

Flutterwave

XpressPay (operated by Xpress Payments Solutions Limited)

These PSSPs are integral to a “transparent and competitive ecosystem” designed to facilitate efficient tax payment across all channels.

3. The Backstory: Atiku’s Allegation of ‘Lagos-Style Cartel’

The controversy began when the federal government appointed XpressPayment Solutions Limited as a Collecting Agent under the Treasury Single Account (TSA) framework, enabling taxpayers to use its platforms (like XpressPay and e-Cashier) for FIRS payments, including Company Income Tax (CIT), Value-Added Tax (VAT), and Withholding Tax (WHT).

Former Vice President Atiku Abubakar argued that this appointment granted the firm monopoly control over the revenue system. He likened the move to a “Lagos-style revenue cartel” and warned that introducing a private firm into core government revenue operations threatens institutional integrity and transparency, suggesting it was “state capture masquerading as digital innovation.” He also questioned the lack of consultation or National Assembly oversight on the decision.

4. FIRS Clarification: PSSPs Do Not Control Government Revenue

The FIRS offered crucial clarification on the role of Payment Solution Service Providers, countering the allegation that they control public funds.

Direct to Federation Account: All payments made through the PSSP platforms flow directly into the Federation Account without any diversion, intermediaries, or private control.

No Collection Fees: The PSSPs are not designated as collection agents and do not earn processing fees or percentages from the actual government revenues.

The current framework, according to the FIRS, is designed for increased accountability and also promotes growth in the financial technology sector by encouraging innovation and competition among multiple vendors.

5. Commitment to Transparency and Tax Reforms

The FIRS maintained that the onboarding of all PSSPs, including Xpress Payments, follows a “clear and verifiable process” that ensures fairness.

The agency further asserted that the ongoing national tax reforms, championed by the Presidential Committee on Fiscal Policy and Tax Reforms, are central to the country’s economic modernization and should not be politicized.

The FIRS urged political actors like Mr. Atiku Abubakar to refrain from spreading misinformation, reaffirming its commitment to professionalism and continuous strengthening of Nigeria’s revenue-collection system for the benefit of all citizens.

According to the NCAA, the infractions include short-landed bags, instances of missing and mishandled luggage, problems with flight delays and cancellations, and failing to reimburse passengers within the allotted period.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes