Ten Nigerian States Seek N4.287 Trillion in Loans for 2026 Budget as Borrowing Rises

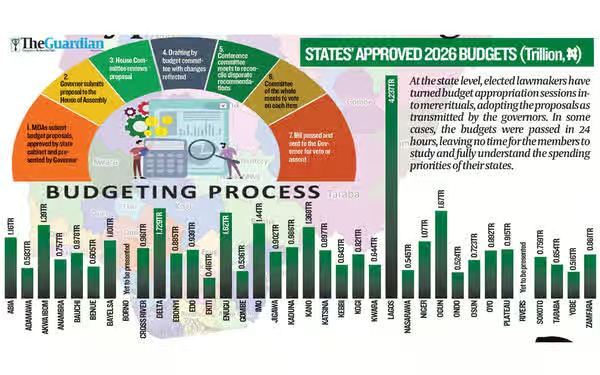

Fresh findings from state budget documents have revealed that ten Nigerian states are planning to raise about N4.287 trillion in loans for 2026 budget. Bonds, grants, capital receipts, and public-private partnerships to finance capital projects are outlined in their 2026 budget proposals.

The states involved include Lagos, Abia, Ogun, Enugu, Osun, Delta, Sokoto, Edo, Bayelsa, and Gombe.

Together, the states have presented budgets totaling N14.174 trillion to their respective state assemblies, pointing to a growing dependence on nonrecurring funding sources beyond federal allocations and internally generated revenue. This rising reliance on borrowed funds highlights the increasing pressure on state governments to secure alternative financing in order to meet their development goals.

Findings show that while statutory transfers from the Federation Account Allocation Committee, value-added tax receipts, and internally generated revenue remain major income sources, many states are now turning more aggressively to loans and grants to bridge funding gaps and push through infrastructure and social development projects. The trend has become more noticeable in recent budget proposals, raising concerns about long-term fiscal sustainability.

Economists and labor leaders have raised concerns that the growing dependence on borrowing reflects weak fiscal discipline and revenue leakages rather than a true lack of income. They have warned that excessive borrowing could place heavy debt burdens on future generations and limit the ability of states to invest in critical sectors over time.

In Lagos State, Governor Babajide Sanwo Olu proposed a N4.237 trillion budget for 2026, with about N1.117 trillion expected to be sourced from loans and bonds to fund capital projects. This represents 26.4 percent of the state budget, despite Lagos having one of the strongest internally generated revenue bases in the country. The Lagos borrowing plan forms a significant part of the wider N4.287 trillion in loans for 2026 budgets being pursued by the states.

Abia State proposed a N1.016 trillion budget, which includes a financing gap of N409 billion, representing 40.3 percent of its budget. The state government plans to cover this gap through borrowing and other nonrecurring revenue sources. Data from the Debt Management Office indicates that Abia recorded a significant reduction in its domestic debt in 2025, offering some reassurance to investors and stakeholders.

Ogun State also showed strong reliance on alternative funding sources in its N1.669 trillion budget. The state plans to source N518.9 billion from loans and grants, accounting for over 31 percent of its funding needs for the year.

Some states, including Osun, Delta, and Bayelsa, recorded reductions in their debt profiles in 2025, which may provide them some fiscal breathing space. However, others, such as Enugu and Gombe, continue to rely heavily on loans and capital receipts to fund over 20 percent and over 60 percent of their budgets, respectively.

Fiscal analysts have warned that the heavy reliance on the N4.287 trillion in loans for 2026 budget exposes states to risks associated with funding delays, rising debt servicing costs, and long-term sustainability challenges. They also noted that states with weak internally generated revenue bases may be particularly vulnerable to financial shocks if borrowing continues to rise at the current pace.

As more states turn to borrowing to finance development, the conversation around fiscal discipline, revenue reforms, and sustainable financing is expected to intensify in the months ahead.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes