In the world of technology and finance, the recent results from NVIDIA Corporation (NASDAQ: NVDA) have drawn far more than the usual investor attention. They are being interpreted as a clear beacon of how artificial intelligence (AI) is moving from promise into full-scale deployment — and how the tech industry is being reshaped in real time. What happens at NVIDIA now matters not only for the firm itself, but also for a vast array of industries, emerging markets and technological ecosystems.

For Nigerian business watchers, fintech enthusiasts and tech-savvy professionals, these developments provide a valuable vantage point. In this article, I take you through what the earnings reveal, why they matter, and how this global shift may intersect with the African market and its opportunities.

Table of Contents

Earnings Snapshot: A Breakout Quarter

NVIDIA recently announced its results for the third quarter of 2025, delivering revenue of US$35.1 billion — representing a 94 % year-on-year increase and a 17 % sequential rise compared to the prior quarter, according to AInvest.

The company’s Data Centre business alone pulled in about US$30.8 billion. That segment, which supports high-performance computing, generative AI modelling, and cloud infrastructure, showed an astonishing year-on-year growth of over 100 %. AInvest

What stands out is that we’re not simply witnessing a cyclical upswing in demand. Instead, NVIDIA’s performance reflects a structural pivot in how computing power is being deployed — increasingly focused on AI workloads rather than traditional processing tasks.

From a Nigerian or wider African perspective, this kind of performance is important. It signals that global infrastructure providers, cloud players and enterprise users are committing major resources to AI — which in turn raises the prospect of newer tech-capabilities and services reaching emerging markets faster.

The Engine Behind the Growth: Data Centres, AI Chips and Ecosystems

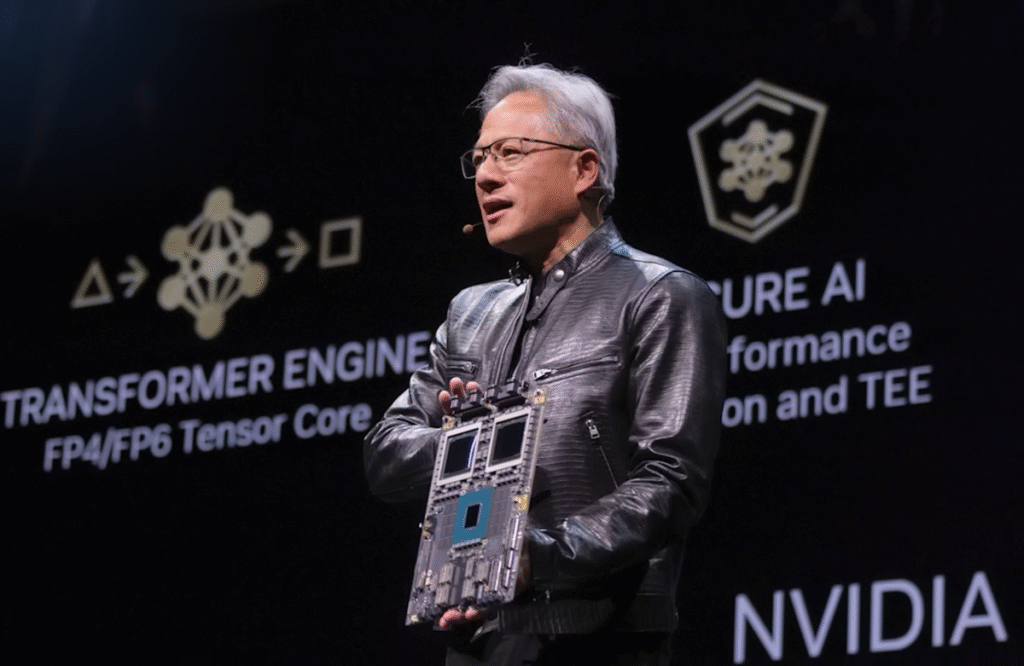

The number one driver behind NVIDIA’s leap is its Data Centre business. The company’s specialised GPU architectures — such as the “Hopper” and “Blackwell” generations — are tailored for the heavy lifting required by large-language models (LLMs), inference engines, research AI and enterprise-grade cloud systems.

This matters because:

- The era of general-purpose chips is giving way to AI-optimised hardware. NVIDIA’s 2.2× performance boost in LLM benchmarks versus its prior generation highlights this shift.

- NVIDIA is increasingly operating as more than just a chip-maker: it is becoming an end-to-end platform — hardware + software + developer tools + ecosystem partnerships. For instance, new platforms like “AI Aerial” (for telecoms) and “Project GR00T” (for robotics) extend its reach.

- The firm has strategic collaborations with global cloud providers (such as Amazon Web Services, Microsoft Corporation Azure and CoreWeave) and emerging-market deployments in countries like India, Japan and Indonesia.

For Nigeria and Africa, here are the implications:

- As cloud and AI infrastructure expand globally, regions slower to adopt risk being left behind — but also have an opportunity to leapfrog older computation architectures.

- Local fintechs, agritech firms and manufacturing players that adopt AI infrastructure early may position themselves for a competitive edge.

- But there will be infrastructural, cost, skills and regulatory challenges — meaning the opportunity is real, yet the path is neither simple nor automatic.

Interpreting the Signal: Why NVIDIA Is a Barometer for Tech Growth

There’s a view among many analysts that NVIDIA’s latest results are more than the success of one company — they serve as a macro-indicator for the broader tech industry’s trajectory. Let’s unpack why.

Indicator of AI investment intensity. The surge in demand for NVIDIA’s AI-specific hardware shows that major enterprises are shifting budgets into AI, not just experimentation. For investors and market watchers, this helps gauge how much capital formation (and consequent tech output) is being committed.

Structural shift in semiconductors. Traditional semiconductor demand—PCs, standard servers—has been under pressure for years. What seems to be happening now is a pivot: chips optimised for AI workloads are becoming the dominant growth engine. That’s what NVIDIA’s performance is signalling.

Globalisation of AI infrastructure build-out. The geographic diversity of deployments (emerging Asia, cloud providers globally) suggests that AI deployment is not just a U.S. or China story—it’s a global phenomenon. That has implications for supply chains, investment flows, and tech adoption in Africa and beyond.

Risk and valuation architecture. Of course, the high growth comes with risks: competition from firms like Advanced Micro Devices, Inc. (AMD) and Intel Corporation is ramping up; supply-chain issues (particularly around 3nm chip production) and geopolitical tensions may hamper momentum.

Hence, when we say NVIDIA is a “barometer”, we mean that its performance reflects the health of multiple interconnected areas: AI hardware demand, cloud infrastructure expansion, new tech ecosystem formation, and global tech-investment trends. For Nigerian readers, that means monitoring NVIDIA (and similar firms) gives insight into where global technology flows are heading—and where opportunities may emerge on our continent.

What Happens Next? Opportunities and Cautions for Africa and Beyond

So having seen what the earnings mean, the question is: what does next look like—especially from a Nigeria/Africa lens?

Opportunities:

- Emerging-market leapfrog: Africa could adopt AI-centric infrastructure quicker (skipping legacy architectures) if investment flows, policy and skills align.

- Localised AI solutions: With global players ramping AI infrastructure, local players could partner to bring AI-powered services—fintech, healthtech, agritech, logistics—to market faster.

- Ecosystem spill-over: As Nvidia supports broader ecosystems (software, developer tools, hardware platforms), African developers and firms may tap into those tools and build niche solutions tailored locally.

Cautions:

- Infrastructure and cost barriers: High-performance AI infrastructure is expensive and power-intensive. Many African markets still grapple with energy, connectivity and capital challenges.

- Skills and ecosystem maturity: Deploying and managing advanced AI models requires both human capital and ecosystem maturity (data, regulation, security). This may lag.

- Concentration risk: Just as NVIDIA’s dominance is a strength, over-reliance on one vendor or hardware architecture can be a strategic risk. Diversification matters.

- Regulatory/ethical risk: As AI expands, issues around data privacy, algorithmic bias and regulation gain prominence—especially in markets where policy frameworks are still evolving.

From a global viewpoint, the next few quarters for NVIDIA and similar firms will test whether the current momentum is sustainable. Investors will watch whether growth persists in the face of rising competition and supply-chain complexity. For Nigeria and Africa, monitoring such global signals helps in aligning strategy: whether in tech investment, policymaking or private-sector innovation.

Conclusion

In summary: NVIDIA’s recently released quarterly earnings are not just notable for their size; they are representative of a wider transformation in the tech landscape — one in which AI-driven computing is becoming the dominant theme. With US$35.1 billion in revenue, and over US$30 billion coming from its Data Centre business, NVIDIA’s performance offers a window into where global tech investment is flowing and how infrastructure is being reshaped.

For Nigerian professionals, investors and innovators, this is a call to pay attention—because the global tech environment is recalibrating, and the ripples will be felt far beyond Silicon Valley. Whether your interest lies in fintech, agritech, infrastructure, the public sector or emerging digital services, the shift is underway.

Keep in mind: while the promise is significant, the reality of deploying AI in emerging markets is complex and demands thoughtful strategy. Yet, if the world is moving towards AI-centric computing, then leveraging local talent, partnerships and creative solutions becomes ever more vital.

The key takeaway: Then you hear that NVIDIA’s quarterly earnings are strong, don’t just see a company hitting numbers—recognise a broader narrative of AI-driven tech growth unfolding. And for Nigeria, the question is: how will we position ourselves to ride the wave rather than watch it pass?

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes