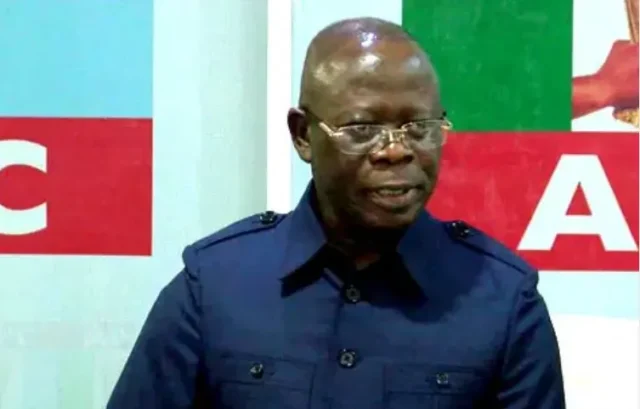

Former governor of Edo state and senator representing Edo north, Adams Oshiomhole, has stated that resistance to value added tax (VAT) is peculiar to Nigeria.

Speaking on Wednesday during his appearance on Channels Television’s ‘Politics Today’, Adams Oshiomhole said the newly enacted tax laws are designed to protect low-income earners.

The former governor of Edo went on to say that by placing a heavier weight on wealthy earnings, the tax policy’s structure matches the principles of a progressive government.

“The facts on the ground show that President Tinubu’s tax policy is consistent with the values of a progressive government,” he said.

Join our WhatsApp community

“This is a progressive tax policy that places a higher burden on those who earn more while offering tax exemptions to those who earn less.”

According to Adams Oshiomhole, public opposition to VAT and other levies is fueled by misconceptions about taxes.

“It is only in Nigeria that people talk about government using money or claim that government earns money on its own,” he said.

“Governments do not earn money; citizens earn income, and the government taxes those earnings — whether individual or corporate.

“The sum of these taxes determines the annual revenue of the state.”

Adams Oshiomhole said that stringent enforcement of tax compliance was necessary.

“Taxes must be paid by those who are supposed to pay it and must be ruthlessly collected. It’s not a civil obligation. It’s a criminal thing if you breach the tax law, and it has to send people to prison if they decline or doctor the tax books. That is what serious governments should do,” he added.

According to the senator from Edo, VAT mostly affects luxury and non-essential goods rather than necessities.

He criticised Nigerians who refuse to pay VAT domestically while paying comparable taxes elsewhere.

“When you and I choose to buy luxury or imported items, then we pay VAT. If you don’t consume luxury, you don’t pay VAT. That is why VAT is fair,” the senator said.

Join our WhatsApp community

“Nigerians pay VAT in London, in America, in Dubai, sometimes up to 20 percent, and nobody complains. Why is it a problem when it is in Nigeria?

“Everywhere in the world, when you buy non-food items, you pay VAT.

“Nigerians pay VAT in America, London, Dubai, yet they resist paying VAT here in Nigeria.”

Join Our Social Media Channels: