The global financial community is taking a deep breath as key share indices slipped yesterday, delivering a sobering wake-up call to markets worldwide. The mood soured after a sharp downturn among major technology companies dragged the U.S. benchmarks lower, and that weakness rippled out to Europe and Asia.

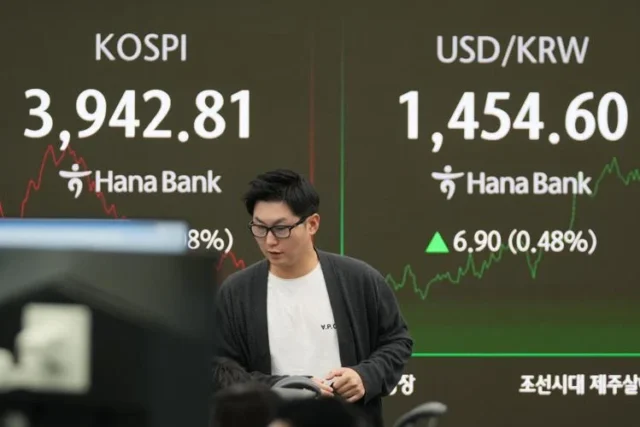

In Tokyo, the Nikkei 225 shed about 1.2 per cent, while South Korea’s KOSPI scuttled 1.8 per cent. Hong Kong’s Hang Seng Index slipped 0.9 per cent and Australia’s benchmark lost around 0.7 per cent. In Europe, Germany’s DAX dipped 0.1 per cent and the UK’s FTSE 100 fell 0.4 per cent — while U.S. futures only edged up modestly, signalling caution rather than confidence, according to AP News.

Why the thump? A few large tech companies, long-seen as the engines of market gains, stumbled. The slide in these names undermined broader investor sentiment and raised fresh questions about valuation and momentum. Combined with weakening export data from China and broader economic ambiguity in the U.S., the global markets took their cue and eased back.

Table of Contents

Tech Trouble and the Domino Effect

The heart of the matter lies with technology — the sector that has done heavy lifting for stocks lately. But when those leading names show cracks, the spill-over is swift. In this case, companies such as Nvidia and Microsoft saw sharp declines, dragging indexes with them. For example, Nvidia lost about 3.7 per cent and Microsoft dropped 2 per cent in the latest session, per ABC News.

In the U.S., the S&P 500 slipped 1.1 per cent and the Nasdaq Composite suffered a 1.9 per cent fall. The sheer size and weight of tech names in these indices amplifies their impact.

It’s not only the tech giants. The broader picture shows that despite a stellar year — markets reaching record highs in many regions — increasing anxiety about over-valuation and fading growth momentum has begun to surface. Investors seem to be questioning: if tech leads the rally, what happens when it stalls?

Economic Context: More Than Just Stocks

Behind the market jitters lies a mix of economic and geopolitical factors that are turning up the volume on uncertainty. For one, China reported a 1.1 per cent drop in exports in October, and shipments destined for the U.S. plunged 25 per cent year-on-year.

Meanwhile, in the U.S., the ongoing government shutdown is creating data blackouts in key areas such as employment and retail trade. Without fresh figures, markets struggle to craft a clear narrative of how the economy is faring, making them more sensitive to shocks.

Even oil touched higher levels, yet currency moves were mixed — the dollar rose slightly against the yen while the euro slipped. Such dynamics are a reminder that global markets are interconnected in ways that can magnify stress when sentiment turns.

What This Means for Nigeria and African Markets

From the vantage point of Nigerian and wider African investors, the global retreat serves as a cautionary note rather than an immediate alarm. Though our domestic markets are not as tightly coupled with U.S. tech stocks, the psychology of foreign capital and sentiment still matters.

When global risk appetite cools, foreign investors may reduce exposure in emerging markets, and currencies in African economies may weaken relative to the dollar. For Nigerian equities and the Nigerian naira, this suggests watching developments abroad closely. Also, companies whose earnings or supply-chains are linked to global demand could feel the ripple.

On the flip side, this offers a moment to reassess portfolios — perhaps trimming overly exposed positions or examining sectors less correlated with global tech swings, as always in markets, diversification matters.

Conclusion

Markets have taken a step back this week, and while it may not signal a full-blown crisis, it’s a reminder that today’s leaders can quickly become tomorrow’s laggards. In the interconnected world of finance, a stumble by one category can resonate broadly — and in Nigeria, that ripple is real, even if indirect.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes