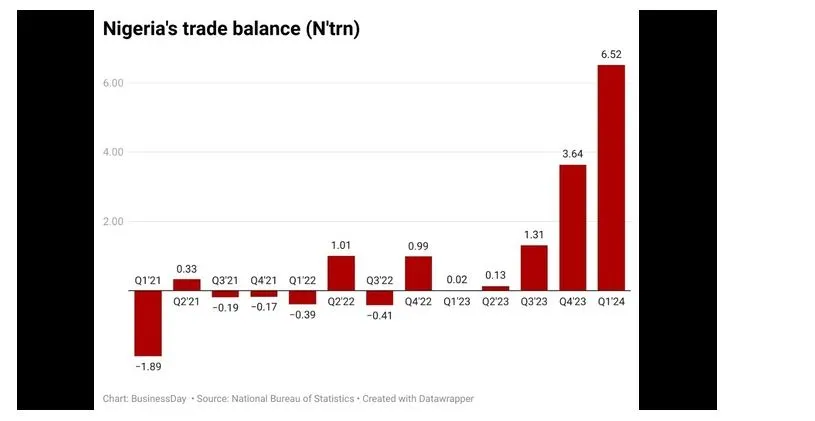

Exports surge from weak naira, hitting 14-year high trade surplus.

- Trade Surplus:

- Q1 2024: N6.52 trillion.

- Increase: 79.1% from Q4 2023 (N3.64 trillion).

- Year-on-Year: From N20.9 billion to N6.52 trillion.

- Total Trade:

- Q1 2024: N31.8 trillion.

- Increase: 46.3% from Q4 2023.

- Year-on-Year: 145.6% increase.

- Exports:

- Q1 2024: N19.2 trillion (60.3% of total trade).

- Increase: 51% from Q4 2023 (N12.7 trillion).

- Year-on-Year: 195.5% increase from Q1 2023 (N6.48 trillion).

- Crude oil: N15.4 trillion (80.8% of total exports).

- Non-crude oil: N3.68 trillion (19.20% of total exports).

- Imports:

- Q1 2024: N12.6 trillion (39.7% of total trade).

- Increase: 39.6% from Q4 2023 (N9.05 trillion).

- Year-on-Year: 95.5% increase from Q1 2023 (N6.47 trillion).

- Currency Impact:

- Naira devaluation (30% this year, 40% last June) increased export value in naira terms.

- Official exchange rate: N1.483.9/$ (up from N463.38/$).

- Parallel market rate: N1.495/$ (up from N762/$).

- Key Insights:

- The weak naira boosts export revenues.

- Positive trade surplus strengthens current account balance, reducing external pressure.

- Increased export demand reflects economic competitiveness.

- Top Trading Partners (Imports):

- China, India, USA, Belgium, The Netherlands.

- Main Imported Commodities:

- Motor spirit ordinary, Gas oil, Durum wheat, Cane sugar for refinery, Liquefied petroleum gases.

- Analyst Comments:

- Exchange rate devaluation linked to higher trade surplus.

- A positive trade surplus aids the current account and may appreciate the currency.

- Current Account Balance: