FG Instructs NNPC to Use Naira for Crude Sales to Local Refineries.

The Federal Government has announced a significant policy shift, directing the Nigerian National Petroleum Company (NNPC) to sell crude oil to the Dangote Refinery and other local refineries exclusively in naira. This move aims to bolster the local currency and stimulate domestic economic activities.

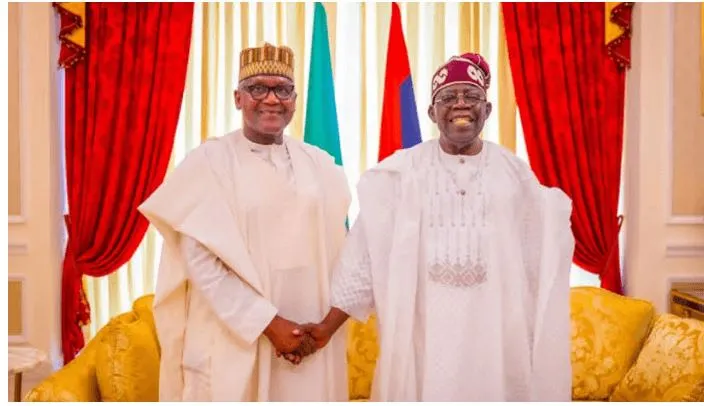

Bayo Onanuga, the special adviser to President Bola Tinubu on information and publicity, stated that the Federal Executive Council (FEC) adopted this proposal as part of a broader strategy to reduce the nation’s reliance on foreign exchange for essential imports. Onanuga highlighted that the Dangote Refinery currently needs 15 cargoes of crude oil, costing approximately $13.5 billion annually, with NNPC committing to supply four of these cargoes.

“The FEC has approved that the 450,000 barrels meant for domestic consumption be offered in naira to Nigerian refineries, using the Dangote Refinery as a pilot. The exchange rate will be fixed for the duration of this transaction,” Onanuga said on his X account.

This innovative approach will involve Afreximbank and other settlement banks in Nigeria, facilitating the trade between Dangote and NNPC Limited without the need for international letters of credit. This measure is expected to save Nigeria billions of dollars that would otherwise be spent on importing refined fuel, thereby reducing the strain on the country’s foreign exchange reserves.

Zacch Adedeji, chairman of the Federal Inland Revenue Service (FIRS), also confirmed the initiative, explaining that the arrangement was facilitated by Afreximbank to promote trade of crude oil in local currency. He noted that about $660 million or N7.92 billion is typically spent on procuring crude, a significant pressure point on the nation’s foreign exchange.

Adedeji elaborated on the expected economic benefits, including a reduction in foreign exchange pressures by approximately 94% and a potential savings in finance costs of around $79 million. He emphasized that the sale of crude oil in naira would make economic predictability a reality and contribute to stabilizing the local economy.

This policy marks a departure from the traditional practice of transacting in foreign currencies and is expected to have a significant impact on Nigeria’s economic landscape, particularly in terms of foreign exchange management and fiscal sustainability.

Share News with us via WhatsApp:08163658925 or Email: naijaeyes1@gmail.com

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes