CBN holds interest rates flat at 27.5% for 7 straight times

The Central Bank of Nigeria (CBN) recently concluded its 301st Monetary Policy Committee (MPC) meeting on Tuesday, July 22, 2025. During this crucial meeting, the committee made key decisions aimed at steering the nation’s economy.

Understanding the Monetary Policy Rate (MPR)

At the heart of the CBN’s monetary policy is the Monetary Policy Rate (MPR). Think of the MPR as the benchmark interest rate—it’s the official rate at which the CBN lends money to commercial banks. This rate is incredibly important because it influences all other interest rates in the economy, affecting the cost of borrowing for businesses and individuals, and ultimately impacting investment and inflation.

CBN’s Decision: Holding Steady at 27.5%

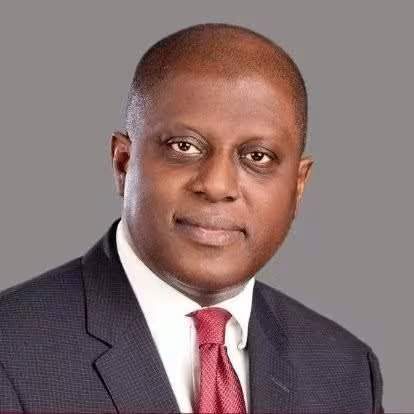

CBN Governor, Dr. Olayemi Cardoso, announced that the MPC unanimously voted to keep the MPR unchanged at 27.5%. This decision reflects the committee’s strategic goal to sustain the disinflationary trend.

Disinflation is a key economic concept that refers to a slowing down of the rate of inflation. It means prices are still rising, but at a slower pace than before. The CBN aims to ensure this slowdown continues and effectively manages price pressures in the economy.

The unanimous vote by all 12 MPC members signals a strong, unified approach among policymakers. This stability in the MPR comes amidst ongoing challenges such as inflationary pressures (though slowing) and fluctuations in the exchange rate.

Other Key Policy Parameters Maintained

Beyond the MPR, the MPC also decided to maintain other critical policy tools:

Asymmetric Corridor at +500/-100 basis points: This refers to the range around the MPR within which commercial banks can borrow from or deposit money with the CBN. An “asymmetric” corridor means the rates for borrowing and depositing are not equally spaced from the MPR. For instance, banks can borrow at MPR + 5% (27.5% + 5% = 32.5%), and deposit at MPR – 1% (27.5% – 1% = 26.5%). This mechanism helps the CBN manage short-term interest rates and influence banks’ liquidity.

Cash Reserve Ratio (CRR) for Deposit Money Banks (DMBs) at 50%: The CRR is the mandatory percentage of a bank’s total customer deposits that it must hold as reserves with the CBN. By keeping the CRR high (50% is very high), the CBN aims to control the amount of money banks have available to lend, thereby influencing the overall money supply and inflation.

Cash Reserve Ratio (CRR) for Merchant Banks at 16%: Merchant banks, which typically engage less in retail deposit-taking compared to DMBs, have a lower CRR.

Liquidity Ratio unchanged at 30%: This ratio measures the proportion of a bank’s liquid assets (easily convertible to cash) to its total deposits. Maintaining this at 30% ensures banks have enough liquid funds to meet their short-term obligations and customer withdrawals, contributing to financial stability.

Governor Cardoso reiterated that keeping these policies stable is intended to manage current and future inflationary pressures. The MPC will continue to closely monitor economic conditions and price trends to guide future decisions.

Balancing Act: Inflation Control vs. Economic Growth

Ahead of the meeting, financial experts had differing views. Some anticipated a slight increase in interest rates to further strengthen the Naira, while others argued for holding rates steady to avoid stifling economic growth, which has been sluggish. The CBN’s decision to maintain rates suggests a careful balancing act: prioritizing the control of inflation while also being mindful of supporting economic stability for businesses and consumers in a challenging environment.

Public Sentiment on Interest Rates

Interestingly, a recent CBN survey highlighted public opinion on interest rates. A significant 62.4% of Nigerians preferred a reduction in interest rates. This indicates widespread concern among households and businesses about the high cost of borrowing under the current tight monetary policy.

When given a choice, 45% of respondents favored lowering rates to improve access to credit, while 40.3% supported increasing them to curb inflation. This divergence in public opinion reflects the difficult trade-offs policymakers face. The survey also revealed a general pessimism about Nigeria’s economic future if inflation continues to rise unchecked.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes