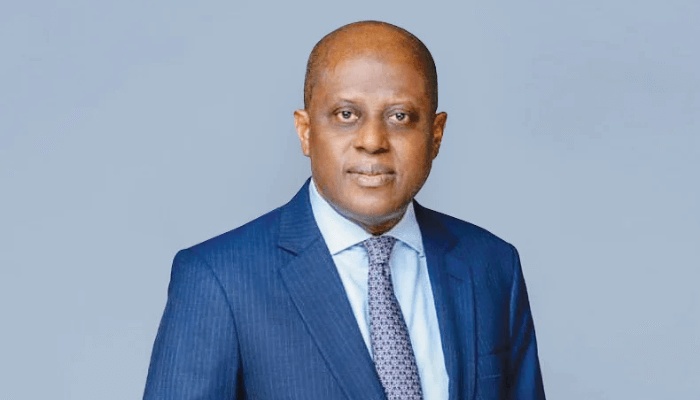

Olayemi Cardoso, governor of the Central Bank of Nigeria (CBN),has revealed that recent economic reforms are strengthening the naira and providing Nigeria a more powerful voice on the international financial scene.

He emphasised the nation’s strategic engagement with the Group of 24 (G-24) and described actions being taken to ensure macroeconomic stability while modernising the country’s digital currency ecosystem and eNaira during his speech at the G-24 media briefing, which was held on the fringes of the ongoing IMF-World Bank Annual Meetings in Washington, DC.

As Vice Chair of the G-24, Cardoso represented Nigeria’s Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

He said: “We’re part of a global framework that seeks to address social inequalities, maintain balance, and correct macroeconomic disorders,” Cardoso said. “Maintaining domestic finances in order is critical. It reduces the burden on governments and ensures that our policies deliver sustainable growth for Nigerians.”

The G-24, which is presently led by Argentina’s Pablo Quirno, organises the stances of developing countries on important monetary and development issues, especially with regard to the World Bank and the International Monetary Fund. Its mission is to advocate for policies that increase funding access, guarantee equitable taxation, and boost economic resilience on behalf of emerging economies in international financial debates.

Cardoso explained that Nigeria’s engagement is not just ceremonial. “The G-24 is a body with shared interests. We regularly meet with the IMF Managing Director and World Bank representatives to understand global challenges. These dialogues are continuous and the insights we gain are instrumental in shaping our domestic economic strategies,” he said.

Cardoso further cited Nigeria’s resilience in the face of global financial pressures.

“Interest rates and tariffs have posed minimal challenges for us. We’ve created buffers that shield the economy. Oil was more exposed, but it was managed effectively. Today, we enjoy a trade surplus of six percent of GDP and a competitive currency that positions Nigeria to grow even further.”

Cardoso also addressed the eNaira, Nigeria’s digital currency. “We’re recalibrating our digital currency landscape, with a focus on the eNaira. Adoption has not been as robust as we hoped, but that doesn’t mean we will abandon it. With our currency strengthening, the eNaira remains a critical tool for financial inclusion and modern payments.”

On Nigeria’s global influence, he added, “Under Argentina’s leadership in the G-24, we’ve advanced our cause and secured a meaningful seat at the table of Bretton Woods institutions. Our voice now contributes to shaping global financial policy in favor of emerging economies.”

![Mr Macaroni Drops Blistering Remark: ‘APC Filled with Most Corrupt People’ as He Slams Tinubu’s Controversial Pardon for Criminals=]] Mr Macaroni](https://naijaeyesblog.com/wp-content/uploads/2025/03/Mr-Macaroni-1-1-180x135.avif)

![Chaos Erupts in Abuja Hotel as BBNaija Star Phyna Sparks Fierce Scene Over Alleged N200,000 Dispute [VIDEO] Phyna](https://naijaeyesblog.com/wp-content/uploads/2024/11/A-Picture-of-Phyna-BBNaija-180x135.jpg)