Nigeria’s financial services landscape is undergoing a quiet revolution. With over 1.5 million agents now active across the country and mobile money transactions climbing by more than 1,500 % between 2021 and 2025, the digital payments wave is reshaping how ordinary Nigerians move money. In this piece, we shine the spotlight on ten entrepreneurs – the owners behind licensed mobile money operators (MMOs) approved by the Central Bank of Nigeria (CBN) – who are at the heart of that transformation.

Table of Contents

The rise of mobile money in Nigeria

The story begins not in plush boardrooms but in the open markets, roadside stalls and bustling commuter parks of Nigeria. As smartphones became more affordable and internet penetration deepened, mobile wallets emerged as the bridge between cash-only communities and the convenience of digital payments.

Data from the Nigeria Inter‑Bank Settlement System (NIBSS) show mobile money transactions hit N20.71 trillion in the first quarter of 2025 — a dramatic leap from N1.28 trillion in the same quarter of 2021. Nairametrics

This explosive growth wasn’t accidental. It was cultivated by entrepreneurs who spotted opportunity in places banks had overlooked: informal markets, remote areas, micro-merchants and everyday Nigerians.

These ten owners, each licensed under the CBN’s mobile money regulatory framework, stand out for their roles in enabling this shift, often combining bold vision with operational grit. Their journeys reflect how fintech is democratizing access to financial services across Nigeria.

Profiles of the 10 owners

Here’s a snapshot of each founder-owner, their company, and how they’ve contributed to the mobile money ecosystem. For readability, we’ve ordered them from number 10 to 1, ascending to the most recent high-profile operator.

10. Leo Stan Ekeh – Owner of KongaPay Technologies Limited

Leo Ekeh acquired Konga Holdings (including KongaPay) in 2018 through Zinox Group and has since been repositioning the platform as one of Nigeria’s trusted digital commerce and payments ecosystems. His blend of e-commerce and fintech experience underpins KongaPay’s role in mobile money.

9. Tayo Oviosu – Owner of Pagatech Limited

Tayo Oviosu is well known for his work scaling Africa-facing payments ventures. Through Pagatech, he has steered mobile money into merchant payments and fintech services, broadening the envelope beyond simple transfers.

8. Sahir Berry & Mahesh Nair – Co-founders of NowNow Digital Systems

Their company, NowNow, has been a notable entrant in the MMO space with a focus on user-friendly mobile wallets and agent networks. The combination of local insight (Berry) and fintech background (Nair) reflects a hybrid talent approach in the sector.

7. Dr Valentine Obi – eTranzact International Limited

Dr Obi has long been active in Nigeria’s payments infrastructure, and his leadership at eTranzact helped position that company as part of the backbone behind mobile and digital transactions.

6. George Zhu Zhaojiang – Founder/Chairman of Transsion Holdings

Though Transsion is better known globally for its mobile handset business, its Nigerian payments play underlines the convergence of hardware and payments. George Zhu’s move into mobile money marks a broader ecosystem play.

5. Peter Ojo – President & CEO of VTNetwork Limited

Peter Ojo has leveraged VTNetwork’s agent network infrastructure to enable mobile money penetration, especially outside Nigeria’s major urban hubs. His focus on agent-led growth resonates with the realities of on-ground distribution.

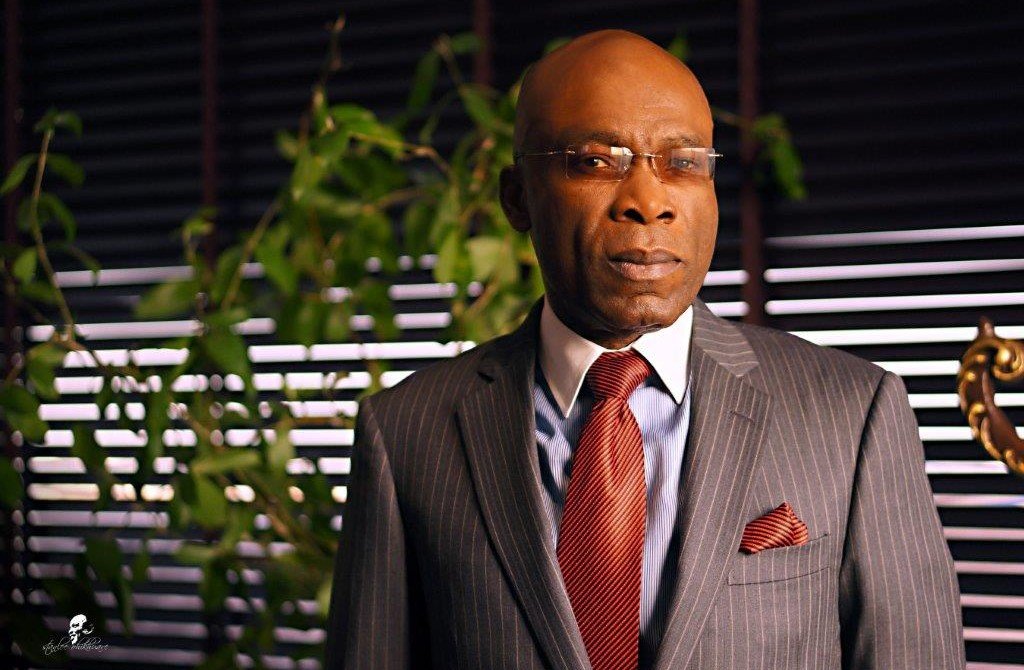

4. Sir Demola Aladekomo – Founder & Chairman of Chams Mobile

Sir Aladekomo is a veteran in Nigeria’s ICT sector, and his Chams Mobile is among the MMOs with legacy strength. His path reflects the early adoption and evolution of digital payments in Nigeria over the decades.

3. Odunayo Eweniyi – Co-founder of PiggyVest

Odunayo Eweniyi (female entrepreneur) is somewhat less traditional in mobile money but stands out for bridging savings/investment fintech with mobile payments. Her presence illustrates diversification in the MMO owner base.

2. Zhou Yahui – Owner of Opay Digital Services Limited

Zhou Yahui leads Opay, a major player in the mobile money space with international backing and an aggressive growth strategy. His approach highlights how global capital and Nigerian market scale converge.

1. Ma Wai Dong – Chairman of A‑Smart Holdings Ltd

At the very top of our list is Ma Wai Dong, whose A-Smart Holdings has secured an MMO licence and reflects the cross-border nature of fintech investment into Nigeria. His presence underscores Nigeria’s integration into global payments flows.

Why these owners matter—and what they tell us

These ten individuals are not merely names on licences; they represent key dimensions of Nigeria’s mobile money ecosystem. Here are four take-aways that emerge from their profiles:

• Diverse backgrounds, one vision.

From Odunayo Eweniyi’s savings-tech credentials to Ma Wai Dong’s international holdings and Sir Demola’s ICT legacy, the owners come from varied professional paths. Yet all converge around enabling convenient access to financial services across Nigeria.

• Agent-led growth is crucial.

As the NIBSS data suggests, much of mobile money’s expansion in Nigeria has been via agents rather than direct user downloads. Owners such as Peter Ojo and Sir Demola Aladekomo have emphasised building robust networks outside city centres.

• Regulation-enabled innovation.

The CBN’s licensing framework for MMOs created space for non-bank players to innovate. These owners seized that regulatory window—turning what might have been a sideline payments play into mainstream financial services with mass adoption.

• Fintech is becoming the next bank.

Mobile money operators in Nigeria are positioning themselves as more than transaction platforms. For example, PiggyVest founder Odunayo Eweniyi is pushing into savings and investment. The signal is clear: the traditional bank may evolve, and these players are designing the new models.

For a country where physical banks still struggle to reach many rural and peri-urban areas, this shift has profound implications. It’s about financial inclusion, yes—but also about economic empowerment, remittance flows, jobs (via agent networks) and bridging the cash-to-digital divide.

Looking ahead: challenges, opportunities and the road forward

While the pace of mobile money adoption in Nigeria is impressive, the journey ahead remains complex. Here are key areas to watch:

Scalability beyond urban centres:

Growth in Lagos, Abuja or Port Harcourt is relatively easier. The real test lies in deepening reach into rural Nigeria, where connectivity, literacy and trust are weaker. Owners like Peter Ojo, who have agent-centric models, may hold the edge here.

Regulatory and security risks:

As volumes rise, regulatory scrutiny will deepen. Fraud, cyber-risk, and compliance failures can erode trust quickly. Leadership from veteran owners such as Dr Valentine Obi and Sir Demola Aladekomo, who have longstanding experience in payments and ICT, will matter.

Profitability and monetisation:

Large transaction volumes look good on paper, but converting them into sustainable profits remains a challenge. Operators must balance low-cost access for users with sufficient margins to support agent networks and infrastructure. The operators led by Leo Stan Ekeh and Zhou Yahui may be well placed, given their e-commerce or global fintech integrative models.

Innovation beyond payments:

Savings, credit, insurance, and financial-health services are increasingly important. Odunayo Eweniyi’s work at PiggyVest points towards this diversification. Mobile money owners who expand their value chain will likely lead the next wave.

Global partnerships and investment:

With operators such as A-Smart Holdings, led by Ma Wai Dong and Opay under Zhou Yahui drawing international capital, Nigeria’s mobile money space is no longer insular. This opens opportunities for cross-border payments, remittances and regional expansion—but also introduces global competition and risk.

Conclusion

Behind Nigeria’s mobile money boom are the stories of visionaries who dared to step into a space where cash reigned and banking reach was limited. The ten owners featured here exemplify that leap. Their journeys reflect Nigeria’s ambitions: to be financially inclusive, technologically empowered and locally rooted yet globally connected.

For Nigerians, the implications are real. From traders in Kano, artisans in Onitsha, to commuters in Lagos, mobile money offers a path to financial services previously out of reach. And for the financial ecosystem, the message is clear: innovation is no longer optional; it’s essential.

As these operators grow, scale and diversify, one thing remains constant: the end-user – the everyday Nigerian – is at the heart of the transformation. And the next chapter may well be written not just by banks, but by the mobile money operators led by those ten names and others who will follow.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes