Effective July 1, 2025, Belgium’s banks introduced a new mandatory step: before processing any online money transfers, they must verify that the beneficiary’s name matches the account number. This enhancement forms part of a national effort to reduce fraud and bolster trust in digital banking.

While the measure may seem modest, it echoes a pioneering model first implemented in Nigeria over ten years ago—with striking efficiency.

Table of Contents

A Look Back at Nigeria’s BVN Revolution

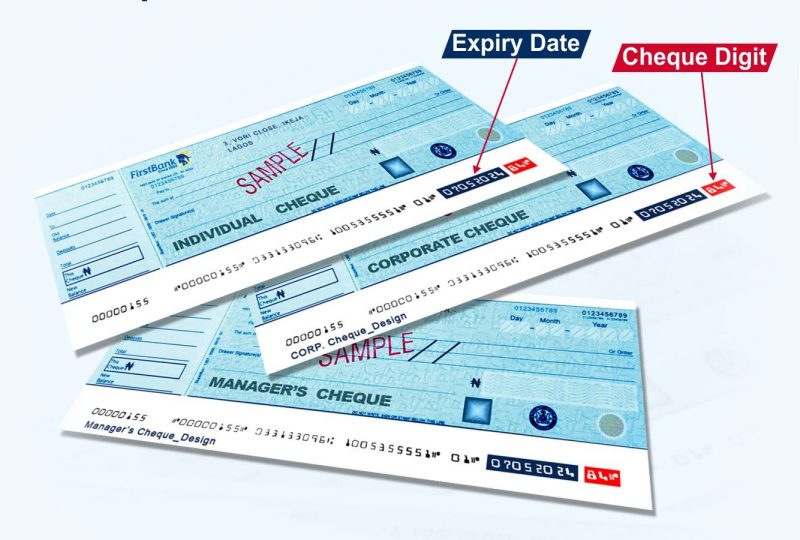

In 2014, the Central Bank of Nigeria (CBN) launched the Biometric Verification Number (BVN) initiative, assigning each bank customer a unique biometric identity. By 2018, it became compulsory for Nigerian banks to confirm that recipient names and account numbers corresponded before transfers were finalized.

This dual-layer of biometric ID and name–account matching dramatically curtailed identity fraud and reshaped public confidence in Nigeria’s banking infrastructure. Moreover, Nigeria took digital finance further with the NIBSS Instant Payment (NIP) system, enabling secure, real-time domestic transfers—even in underserved, rural communities.

Why Belgium Trails (But Can Catch Up)

Belgium stands as a digitally advanced and high-income nation, yet until now it lacked certain safeguards Nigeria had long embraced. The delay reflects deep-rooted legacy systems and a traditional banking mindset that can resist rapid change. In contrast, emerging economies like Nigeria have “leapfrogged” barriers by embracing fintech innovations as a necessity and opportunity.

This policy shift from Brussels, then, is more than a technical tweak—it signifies a growing acknowledgement within Europe of innovation stemming from Africa. It quiets assumptions that progress only travels from North to South.

A Shift in the Innovation Narrative

The conventional narrative—that breakthroughs always flow from developed to developing countries—is now obsolete. Nigeria’s success story in digital finance exemplifies a reverse trend: innovation from the Global South influencing Western financial ecosystems.

As Collins Nweke, a dual-nationality financial commentator, observed:

“Nigeria embedded this in its banking DNA in 2014. By 2018, it was already mandatory to match account names with numbers before completing transfers. It was visionary—and it worked.”

Belgium’s new rule might seem modest, but its real impact is symbolic—a nod to African ingenuity.

Bigger Picture: Fintech, Fraud, and Food for Policy

Belgium’s policy underscores two broader trends:

- Global Recognition of Fintech Innovation – by adopting a BVN-inspired approach, European regulators implicitly acknowledge the Nigerian model as fit for world-class banking standards.

- Necessity as Catalyst – Nigeria’s embrace of fintech wasn’t optional; it was essential to ensure financial inclusion and public trust across both rural and urban populations.

Nweke emphasizes that innovation doesn’t require Silicon Valley or Wall Street. Sometimes, the next big financial leap begins in Lagos, not Silicon Valley.

Irony in Progress: Digital Banking vs. Digital Democracy

A poignant irony emerges: Nigeria now processes billions of naira in seconds via digital platforms, yet it still struggles with fully digitized elections and diaspora voting.

As Nweke pointedly remarks:

“We move billions of Naira across digital platforms instantly, yet we claim that transmitting election results electronically is too complex. It doesn’t add up.”

If Belgian banks can adopt BVN-style controls, it prompts the question: what are governments waiting for?

Lessons for Europe, Africa, and Beyond

- For Europe: Learn from faster-moving economies—be open to adopting best practices regardless of origin.

- For African nations: Nigeria’s fintech journey sends a clear message: digital innovation can fuel trust, inclusion, and efficiency.

- For global regulators: Agility and context matter more than the perceived pedigree of origin.

Belgium’s adoption of a Nigerian-inspired standard may be nearly a decade late—but the critical takeaway is that brilliant ideas can—and do—travel uphill.

What’s Next

Belgian banks will monitor the new measure’s impact on fraud rates and customer trust. Success could pave the way for additional innovations—like instant payments and open banking frameworks. For Nigeria, this is already business as usual. For Belgium, it could be the catalyst for a more agile, secure, and inclusive financial landscape.

Final Take

The key lesson? Innovation isn’t bound by geography. When a high-income nation adopts a solution from a developing country, the global order of innovation shifts. Belgium’s move is more than a policy update—it’s a recognition that excellence can emerge anywhere.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes