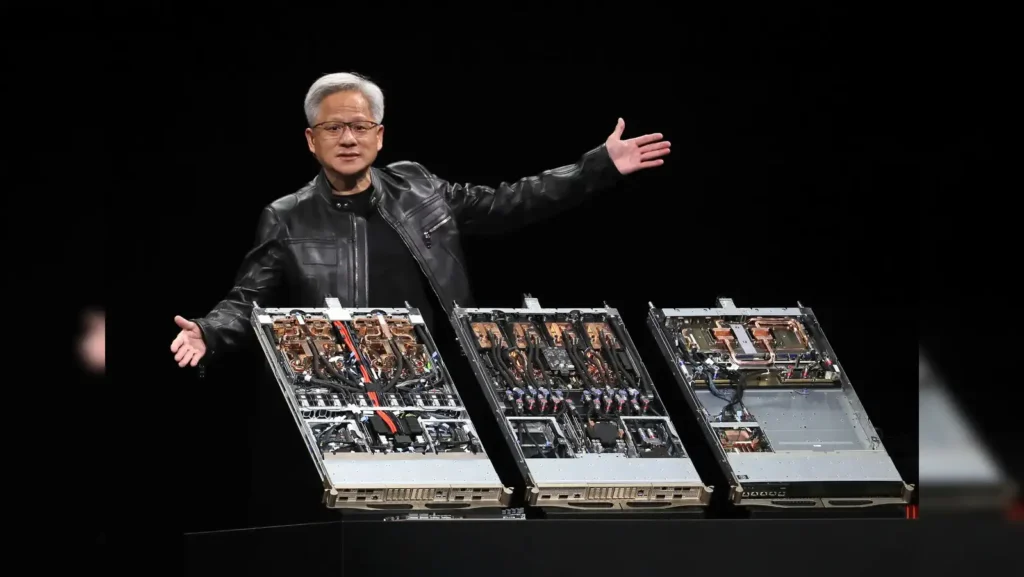

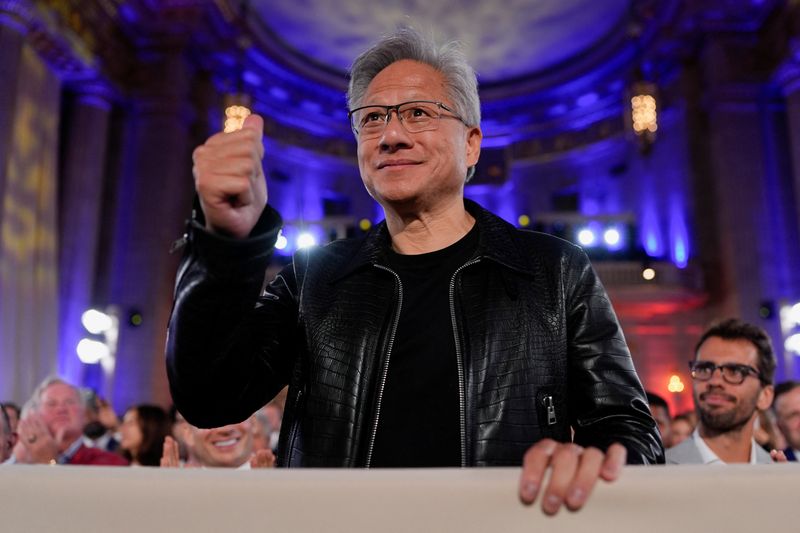

In a world still buzzing with AI hype, Nvidia’s boss, Jensen Huang, has stepped forward to offer a calm, measured voice. On Thursday, August 28, 2025, he dispelled murmurs of a cooling AI chip market, insisting that the rush is far from ending—and in fact, has just started. This is more than just CEO optimism; it’s a statement about the way the entire tech economy is shifting.

Nvidia, central to the AI revolution, gave a third-quarter revenue forecast that matched expectations but fell short of the stratospheric levels some investors had hoped for. Still, Huang’s bullish tone wasn’t dampened. Describing AI as “a new industrial revolution,” he sees a potential USD 3-4 trillion in infrastructure spending by 2030—suggesting a long runway ahead for AI investments, according to Reuters.

Table of Contents

Market Reactions: Blips or Breathers?

On the financial front, it wasn’t all sunshine. In Frankfurt, Nvidia’s shares dropped 2.9% following the earnings report, as investors digested what some viewed as cautious guidance in the data centre segment. Back home in the U.S., analysts noted that the projected USD 54 billion for Q3 (±2%) was in line with expectations—but not enough to turbo-charge stock price moves.

Still, a broader look reveals resilience. Even amid whispers of investor fatigue over AI, Nvidia shares have outperformed the general market—rising roughly 10%, compared to the broader benchmark’s milder gains. Firms like Raymond James and Globalt Investments argue that this reflects the durability of Nvidia’s core AI business rather than bubble-driven speculation.

Chips, China and Capital – The Drivers of Tomorrow

What’s behind this unwavering optimism?

First, demand remains strong across the board—not just for Nvidia’s new Blackwell processors but even for the earlier-generation Hopper chips.

Second, Nvidia disclosed a staggering USD 650 million sale of its H20 chip to a non-Chinese buyer—significant because H20 is a variant typically aimed at China’s market. This underscores global demand beyond geopolitical hotspots.

Third, Huang highlighted the massive capital expenditure underway—estimating around USD 600 billion this year from mega tech firms like Microsoft and Amazon, a market of which Nvidia could capture roughly USD 35 billion based on a single USD 60 billion data-centre build-out.

Yet, China remains an uncertainty. U.S. export restrictions and shifting regulations have clouded the picture. Though potential H20 sales to China could add up to USD 5 billion, final approvals remain pending. That said, the recent USD 650 million sale outside China serves as a testament to global appetite.

Looking Ahead: Momentum or Mirage?

As with any booming sector, the question lingers: is this real growth—or bubble emotions?

Voice of caution came earlier this month when OpenAI’s Sam Altman warned that investors might be “overexcited.” Yet Huang shrugged it off, saying, “The more you buy, the more you grow,” and summed up demand: “Everything sold out.”

Some analysts echo Huang’s confidence. Despite Nvidia’s stock take-off—gaining 930% since ChatGPT’s launch—any recent dips are seen as temporary, not signs of a bursting bubble. Jefferies reiterated a “Buy” rating, pointing to still-strong fundamentals and maintaining its USD 200 target, according to Barron’s. And investors like Raymond James point to the ongoing cap-ex cycle among hyperscalers, which continues to drive Nvidia’s growth.

Yet geopolitical risks, especially regarding China, remain very real. Market volatility around H20-related restrictions and slow approvals still clouds the outlook.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes

![Trailblazing Chef Hilda Baci Set to Cook 250 Bags of Rice in Daring Attempt to Break Record for World’s Biggest Jollof Pot [VIDEO] Hilda Baci](https://naijaeyesblog.com/wp-content/uploads/2025/09/hilda-1-180x135.avif)