Nigeria’s homegrown fintech champion, Remita, has emerged not merely as a payment gateway, but as a mission-critical financial infrastructure—the backbone powering both public and private digital transactions across Africa. Developed by SystemSpecs and managed under Remita Payment Services Limited (RPSL), the platform was born from a need to tackle Nigeria’s complex financial ecosystem—fragmented banking, multi-layered regulations, and inconsistent infrastructure—that foreign imports couldn’t address effectively.

Table of Contents

Built for Scale, Designed for Reliability

Remita’s architecture is impressive in both scale and intention. Seamlessly connecting with all Nigerian commercial banks and over 600 microfinance banks, the platform supports more than 5,000 billers and serves a diverse mix of over 150,000 institutions—from multinational corporations to grassroots SMEs and individual users—who rely on it for payroll, treasury, billing, and more.

The numbers speak volumes: annual transaction volumes range between ₦20 trillion and ₦60 trillion (cumulative value surpassing ₦250 trillion), reflecting a relentless pace of national economic activity. This is not simply digital noise—it’s the salary of teachers, the pension of retirees, and taxes fueling government programmes.

At the core of this ecosystem is the patented 12-digit Remita Retrieval Reference (RRR)—a unique identification code for each transaction that ensures traceability down to a decade-old record. Real-time reconciliation across multiple banks is now the rule, not the exception—an essential capability in a country where multiple accounts and uncoordinated payments once facilitated systemic inefficiencies.

Institutional Credibility and Government Adoption

Remita’s journey began early, first enabling the Integrated Personnel and Payroll Information System (IPPIS) in 2006, which exposed government payroll fraud and helped save over ₦400 million by eliminating ghost workers. However, its breakthrough came in 2012, with full-scale adoption to power Nigeria’s Treasury Single Account (TSA) by 2015. This single consolidated government revenue is from thousands of ministries, agencies, and departments, eliminating wastage and enforcing accountability.

Reported savings attributed to Remita’s TSA deployment exceed ₦10 trillion cumulatively, with annual cost avoidance of around ₦540 billion, fortified by streamlined oversight and fraud reduction. Beyond federal implementation, more than 25 state governments now rely on Remita’s TSAs. The platform’s public-sector credibility extends to global recognition, with nods from the Central Bank of Nigeria and interbank bodies like NIBSS.

A Platform for the Private Sector

Remita’s influence transcends government. Over 150,000 businesses—and 400+ financial institutions—use its APIs for collections, payroll, tax, pensions, and loan underwriting. With millions of aggregated data points processed daily, Remita is more than a gateway—it holds the keys to data-driven finance, enabling tailored risk assessment and fostering tertiary-lending accessibility for individuals like Osun farmers seeking microloans.

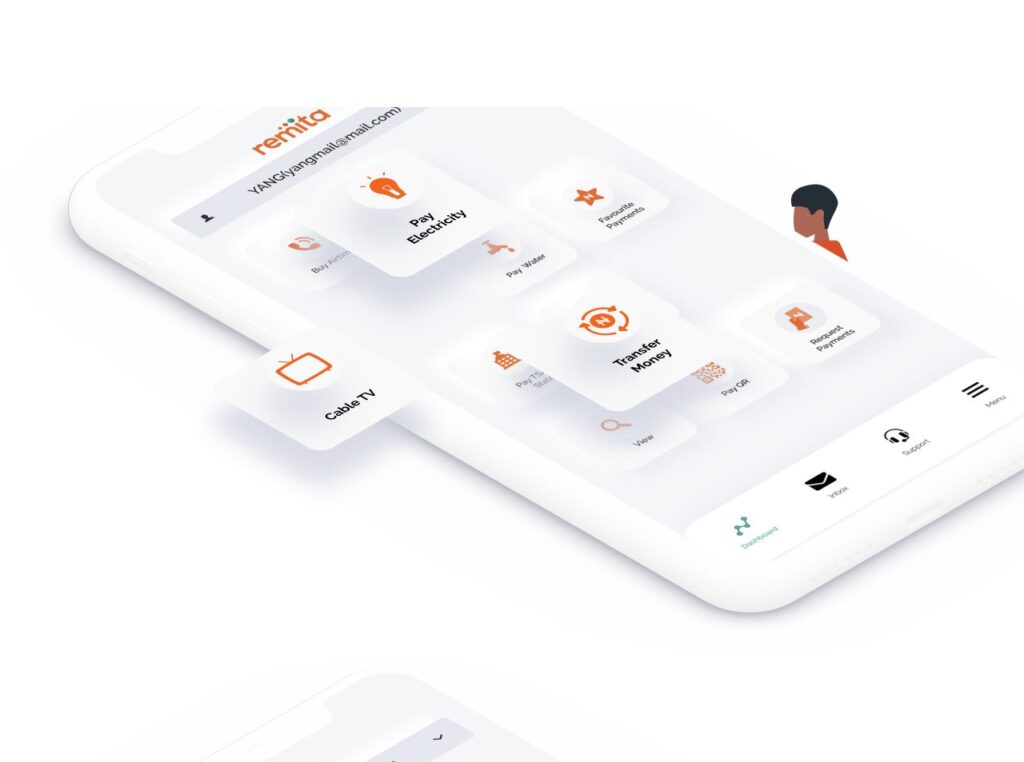

The launch of Remita’s mobile app in 2017 further pushed its reach into the SME and individual segments, contributing to broader financial inclusion across Nigeria.

Embracing AI: Fueling the Next Wave of Innovation

Remita leads Africa’s fintech scene not just technologically, but strategically. In April 2025, it rolled out a landmark white paper titled Unlocking the Power of AI in Nigeria’s Fintech Sector, projecting that the country’s AI-driven fintech market will soar to $434 million by 2026, growing at a compound annual rate of 44.2%. The report calls on fintech players to embed AI in operations, customer service, fraud detection, credit scoring, API deployment, and product innovation.

Remita itself offers early proof: internal AI tools such as a Product Knowledge Assistant and Developer Assistant have already boosted customer satisfaction by 40%, halved API integration timelines, and reduced human inquiry load by 19%. These tools exemplify the phrase “innovate by design—not by enforcement”—positioning Remita to future‑proof Nigeria’s fintech and ensure resilient, inclusive growth.

A Homegrown Model for Pan‑African Ambition

Unlike many platforms built overseas, Remita is firmly rooted in Nigerian soil—developed locally by SystemSpecs since 2003—and represents a successful model of sovereign tech ownership. By owning its IP and maintaining control over data flow, Nigeria has not only reduced reliance on external systems but built a template for scalable, African-led fintech innovation.

Remita’s new corporate identity as RPSL in 2021 further underscores its commitment to scaling payment tech, APIs, and new services—launchpads for expansion across Africa. With regional integration efforts like AfCFTA advancing, Remita is positioning itself to support cross-border remittances, pan-African compliance, taxation workflows, and identity management—all powered by its proven infrastructure.

The Road Ahead

Remita isn’t chasing attention—it’s quietly laying pipelines beneath the continent’s financial future. It has already transformed public finance, professionalised private sector processes, and harnessed AI to elevate efficiency and inclusion. And its vision extends beyond Nigeria, towards African economies seeking trusted, sovereign-backed infrastructure.

As the AfCFTA reshapes trade and integration, Remita stands ready: an ecosystem of financial rails, data engines, and compliance tools built for millions, not algorithms, and rooted in the belief that African solutions can power global change.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes