Banks profit tripple to N1.1trn.

Nigeria’s major banks experienced a significant increase in profits during the first quarter of 2024, with earnings more than tripling compared to the same period in the previous year. This surge in profits was primarily attributed to the Central Bank of Nigeria’s record hike in benchmark interest rates.

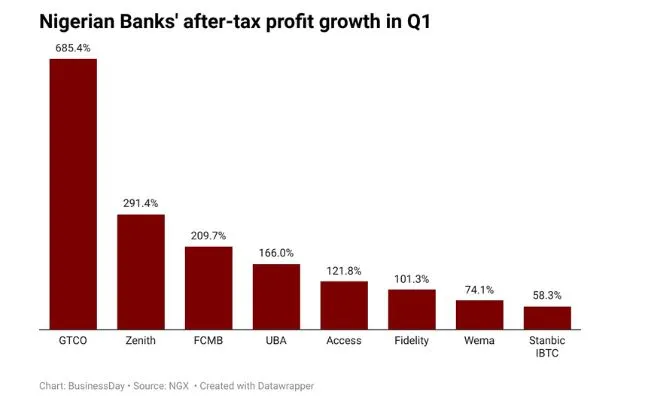

The banks’ after-tax profits collectively rose by 264.5 percent, reaching N1.13 trillion, driven by a growth in interest income resulting from effective asset repricing in response to the elevated interest rate environment. Notably, GTCO, Zenith, and FCMB led in profit growth. The spike in profits was also supported by growth across all major income lines, including interest income, investment securities, and cash balances with banks. The CBN’s efforts to fight inflation through monetary policy rate hikes, along with the liberalization of the foreign exchange regime, contributed to the banks’ performance. Despite the challenging economic conditions, the banking sector has demonstrated resilience, although challenges such as increasing minimum capital requirements remain.

Share News with us via WhatsApp:08163658925 or Email: naijaeyes1@gmail.com

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes