Nigeria’s Oil Industry Sees Zero FDI Inflow.

Decline in FDI

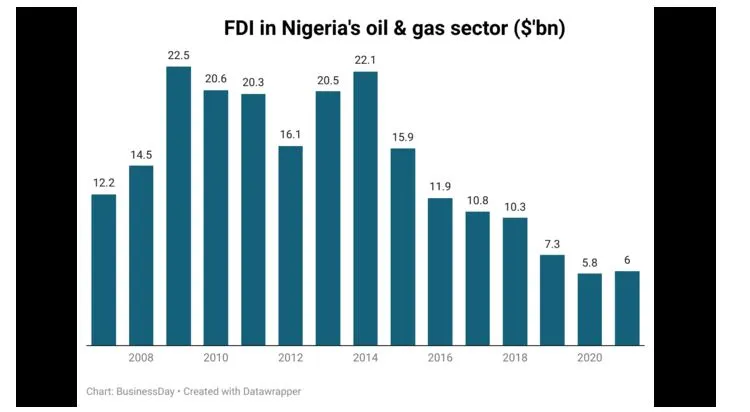

- FDI in Nigeria’s oil sector fell to less than half a billion dollars in the first half of 2023, down from a peak of $22.5 billion in 2019.

- An oil executive highlighted the need for $25 billion annually to achieve a production target of 2 million barrels per day.

Historical Context

- In the 2010s, Nigeria attracted significant FDI, peaking at $22.1 billion in 2014, fueling major projects in deepwater exploration and new oil fields.

- By 2014, Nigeria’s oil production averaged 2.2 million barrels per day with oil prices over $100 per barrel.

Recent Challenges

- Oil prices collapsed in late 2014, leading to economic and security issues.

- Major oil companies like Shell, ExxonMobil, Eni, and TotalEnergies have exited, exacerbating the situation.

Current State

- As of April 2023, Nigeria’s oil production dropped to less than one million barrels daily, well below its OPEC quota.

- FDI in the oil sector was almost nonexistent in the second quarter of 2023, with only $750,000 in the first quarter.

Structural Issues

- Corruption and mismanagement in asset sales have led to sector underperformance.

- Political connections rather than capacity became the qualifying criteria for managing oil assets, causing further decline.

Future Prospects

- The Nigerian government aims to secure $20 billion in oil sector investments in the coming months.

- Local operators are struggling to maintain production and extract value from divested fields, which previously yielded high returns under international oil companies.

Share News with us via WhatsApp:08163658925 or Email: naijaeyes1@gmail.com

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes