The Securities and Exchange Commission (SEC) of Nigeria has sounded a strong warning to citizens about a disturbing trend: investment scams powered by artificial intelligence (AI) are spreading fast across the country. These fraudulent schemes are becoming more sophisticated, making it harder for ordinary Nigerians to distinguish genuine opportunities from cleverly packaged traps.

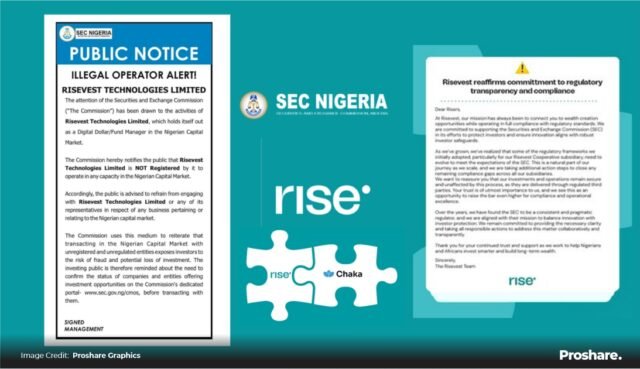

According to the regulator, operators of unregistered platforms such as CBEX, Silverkuun, and TOFRO are targeting investors with fake promises of quick and massive profits. These platforms are not registered with the SEC yet boldly advertise themselves online using advanced AI tools. From fabricated testimonials to manipulated videos of well-known personalities, the scams are designed to deceive people into parting with their hard-earned money.

The SEC’s message is clear: Nigerians must be alert, because these AI-powered scams are growing in both number and influence.

Table of Contents

How The Scams Operate

The methods used by fraudsters are evolving. In the past, many scams relied on simple flyers, radio jingles, or word-of-mouth marketing. Today, scammers have moved to the digital space where AI is used to produce convincing materials that can fool even the most careful person.

A common tactic is the use of deepfake videos — manipulated footage where politicians, celebrities, or respected figures appear to endorse a fake investment scheme. For instance, scammers may show a video of a popular TV presenter “explaining” how an AI-powered trading platform guarantees huge returns. These videos circulate on Facebook, Instagram reels, WhatsApp groups, and Telegram channels, giving unsuspecting viewers the impression that the schemes are legitimate.

The scams also include AI-generated testimonials. Fake reviews and fabricated success stories are produced to convince potential investors that thousands of people have already benefited. In reality, no such investors exist — it is all part of the illusion.

What makes these scams especially dangerous is their appeal to people’s hopes. In a country where economic hardship is biting harder, many Nigerians are searching for extra income streams. Fraudsters exploit this desperation, dangling offers of quick wealth that seem hard to resist.

SEC’s Response And Collaboration With Other Agencies

The SEC is not standing still. In its latest public statement, the Commission said it has stepped up surveillance and deployed more advanced monitoring systems to detect suspicious platforms in real time. This proactive stance is necessary because AI tools can generate fake websites, adverts, and testimonials at incredible speed.

Beyond technology, the SEC is also strengthening partnerships with other agencies. It is working with the Central Bank of Nigeria (CBN) and the Nigerian Financial Intelligence Unit (NFIU) to close gaps that fraudsters exploit. By sharing intelligence and coordinating enforcement, these agencies aim to dismantle fake platforms before they lure in more victims.

The regulator also stressed that public education is a key weapon. Nigerians must understand that not every investment advertised online is genuine. As the SEC explained, many of these platforms operate outside Nigeria, making them difficult to trace once they vanish with people’s money. Raising awareness will help potential victims ask the right questions before investing.

How Nigerians Can Protect Themselves

The rise of AI-driven scams calls for greater caution from investors. The SEC provided several tips for citizens:

- Verify registration. Always check if an investment platform is registered with the SEC. If a company is not on the official list, avoid it.

- Scrutinise endorsements. Do not trust a video or advert simply because it features a famous face. Deepfakes can make it look like anyone is promoting a product they know nothing about.

- Question guaranteed returns. Any scheme that promises fixed profits with little or no risk is almost certainly fraudulent. Real investments carry risks, and no platform can “guarantee” extraordinary returns.

- Stick to reliable sources. Get information from official websites and credible media outlets, not from random social media groups or anonymous messages.

- Report suspicious activity. If you encounter a suspicious scheme, report it immediately to the SEC, CBN, or NFIU. Early action can save others from losing money.

By following these steps, Nigerians can reduce their chances of falling prey to AI-powered fraud.

The Bigger Picture

The SEC’s warning is part of a global conversation. Around the world, regulators are grappling with the rise of AI in financial crime. In the United States, the Federal Trade Commission (FTC) recently issued alerts about AI-based scams using cloned voices to impersonate relatives in distress calls. In Europe, watchdogs are investigating how deepfake technology is being used to trick investors into fake trading platforms.

For Nigeria, the challenge is twofold. On one hand, AI offers opportunities to strengthen financial systems, improve monitoring, and expand inclusion. On the other hand, the same technology is being misused to exploit vulnerable populations. Without strong regulation and public awareness, many citizens risk losing their life savings.

The SEC’s intervention is therefore timely. By highlighting specific platforms like CBEX and Silverkuun, the Commission is sending a signal to both investors and fraudsters. To investors, the message is: “Do your homework before investing.” To fraudsters, the warning is clear: “You will be caught.”

Conclusion

Artificial intelligence is reshaping many industries, from banking to healthcare. Unfortunately, scammers are also taking advantage of its power. For Nigerians, the best defence is vigilance — asking questions, verifying claims, and refusing to be rushed into “get-rich-quick” offers.

The SEC has raised the alarm, but the responsibility also lies with every individual investor. By staying informed and cautious, Nigerians can avoid becoming victims of the next AI-powered investment scam.

Join Our Social Media Channels:

WhatsApp: NaijaEyes

Facebook: NaijaEyes

Twitter: NaijaEyes

Instagram: NaijaEyes

TikTok: NaijaEyes