In the past few days, there has been a lot of interest from the public and stakeholders regarding the Nigerian National Petroleum Company Limited $3.3 billion crude oil pre-payment loan, also known as Project Gazelle.

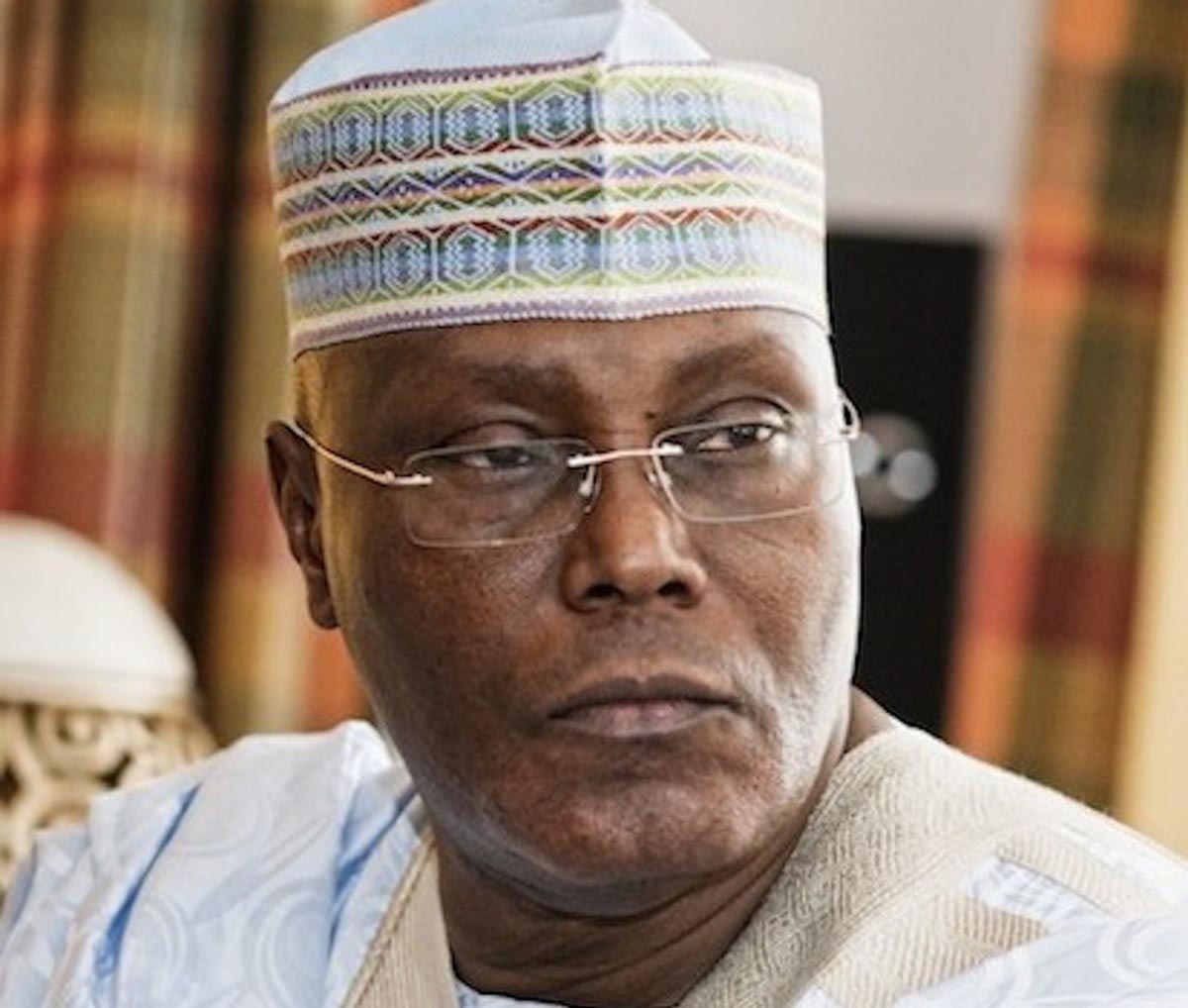

The latest of such interest was from former Vice President Atiku Abubakar through a statement asking President Bola Tinubu to account for the Nigerian National Petroleum Company Limited’s $3.3 billion emergency crude repayment loan.

Atiku, who was the 2023 presidential candidate of the Peoples Democratic Party had on Thursday, insisted that there were questions to be answered on the integrity of this deal, and charged the federal government to talk directly on details behind the deal.

He had asked, “Has the federal government accessed the loan? Is the loan in the government’s borrowing plan as approved by the National Assembly? Who are the parties to the loan, and what specific roles are they expected to play? What are the conditions of the loan, including tenor, repayment terms, the collateral, and the interest rate? And, lastly, why register an SPV in the Bahamas knowing the recent scandal of the country’s notoriety for warehousing unclean assets?”

This piece will attempt to provide answers to some of the issues raised by the former VP.

For a start, the financing agreement secured by the NNPCL to prepay future royalties and taxes to the federal government is a crude oil-backed, forward sale structured finance facility sponsored by the National Oil Company, which acts as the seller and sponsor. The facility involves the forward sale of a specific number of barrels of crude oil to a Special Purpose Vehicle (SPV), which has approached international financial institutions for the required funding.

Under this project, NNPC Limited agrees to sell a predetermined quantity of future barrels of crude oil production in advance while securing upfront payment from a special purpose vehicle (SPV) backed by international financial institutions.

This project provides immediate United States dollar financing for NNPC Limited’s operational needs, including paying its tax and royalty obligations to the Federal Government upfront.

By using the upfront funding, Nigeria can maintain the stability of its currency, the Naira, and increase its foreign exchange reserves. This can also be achieved by increasing oil production and exports, but due to current investment limitations, forward-sale contracts, such as the one used in NNPC Limited’s Project Gazelle, offer a more immediate solution. Forward-sale contracts enable resource-producing companies like NNPC Limited to receive significant upfront funding for new projects before production and export.

The funding can then be used for investments in existing and future resources, leading to increased oil and gas production and higher exports, resulting in more dollars and foreign currencies entering the country. International banks have a history of providing forward-sale financings, which can bring new foreign direct investments (FDIs) into Nigeria.

Already, an initial disbursement of $2.25 billion has been made, and a second tranche of $1.05 billion is expected to be disbursed subsequently.

The United Bank for Africa Plc (UBA) acted as the Local Arranger and Onshore Account Bank for the transaction, which is expected to ease the foreign exchange illiquidity and stabilise the Nigerian currency market.